Introduction to NRN Property Rights in Nepal

Non-Resident Nepalis (NRNs) have specific rights and restrictions when purchasing property in Nepal. The legal framework governing these transactions has evolved significantly with the enactment of the Non-Resident Nepali Act, 2064 (2008) and subsequent amendments. This comprehensive guide outlines the complete legal process for NRNs seeking to acquire property in Nepal, including eligibility requirements, procedural steps, documentation needs, financial considerations, and tax implications.

The Government of Nepal has established clear guidelines to facilitate property ownership for NRNs while maintaining regulatory oversight. Understanding these regulations is crucial for a smooth property acquisition process. This guide addresses all aspects of the NRN property purchase journey to ensure compliance with Nepalese laws and avoid potential legal complications.

Legal Framework for NRN Property Ownership

Governing Laws and Regulations

The NRN property ownership framework in Nepal is primarily governed by:

- Non-Resident Nepali Act, 2064 (2008): This landmark legislation defines NRN status and outlines property rights.

- Civil Code (Muluki Dewani Samhita) 2074 (2017): Contains provisions related to property transactions and ownership rights.

- Land Revenue Act, 2034 (1977): Governs land registration and revenue collection procedures.

- Foreign Investment and Technology Transfer Act (FITTA): Relevant for NRNs investing through business entities.

- Income Tax Act, 2058 (2002): Specifies tax obligations for property transactions.

Recent Supreme Court decisions have further clarified certain aspects of NRN property rights, particularly regarding agricultural land ownership and repatriation of funds from property sales. These judicial precedents have established important interpretations of existing statutes.

Eligibility Criteria for NRN Property Purchase

NRN eligibility for property purchase in Nepal requires:

- Valid NRN identification card issued by the Non-Resident Nepali Association (NRNA)

- Nepalese citizenship (either current or former)

- Foreign citizenship of another country

- Compliance with investment thresholds as specified by the government

- Clearance from relevant authorities for certain property types

According to the Non-Resident Nepali Act, 2064 (2008), NRNs are permitted to purchase non-agricultural land and residential properties without specific investment limits. However, restrictions apply to agricultural land purchases, which require special approval from the District Land Revenue Office.

Step-by-Step NRN Property Purchase Process

Phase 1: Pre-Purchase Preparations

Step 1: NRN Status Verification

Before initiating any property transaction, NRN status verification is essential. This involves:

- Obtaining a valid NRN card from the Non-Resident Nepali Association

- Verifying citizenship status with the Department of National ID and Civil Registration

- Ensuring compliance with any recent amendments to NRN regulations

Timeframe: 2-4 weeks

Step 2: Property Selection and Due Diligence

The property selection process requires thorough due diligence:

- Identify suitable properties through reputable real estate agents

- Verify property ownership at the District Land Revenue Office

- Confirm the property is non-agricultural land or obtain necessary approvals

- Check for any encumbrances or disputes related to the property

- Ensure the property has clear title and proper documentation

Timeframe: 2-6 weeks

Step 3: Financial Arrangements

Financial preparation is a critical step:

- Open an NRN-specific bank account in Nepal

- Arrange for currency conversion and fund transfer

- Obtain pre-approval for property financing if applicable

- Set aside funds for taxes and registration fees

Timeframe: 1-2 weeks

Phase 2: Transaction Process

Step 4: Agreement and Documentation

The formal agreement process includes:

- Drafting a sale agreement with legal assistance

- Verifying all property documents with the seller

- Obtaining tax clearance certificates from the seller

- Preparing transfer documents as required by law

Timeframe: 1-2 weeks

Step 5: Tax Payment and Clearance

Tax compliance is mandatory before property transfer:

- Pay applicable registration fees (typically 4% of property value)

- Settle stamp duty (0.5% of transaction value)

- Obtain tax clearance certificate from the Inland Revenue Office

- Ensure all previous property taxes are paid by the seller

Timeframe: 1 week

Step 6: Registration and Transfer

The final registration process involves:

- Submitting all documents to the District Land Revenue Office

- Verification of documents by land revenue officials

- Execution of the transfer deed in the presence of officials

- Issuance of new land ownership certificate in the NRN's name

Timeframe: 2-4 weeks

Phase 3: Post-Purchase Formalities

Step 7: Post-Registration Compliance

After property registration, post-purchase compliance includes:

- Updating property records with local authorities

- Registering for annual property tax payments

- Notifying the NRN Association of the property acquisition

- Ensuring proper documentation storage for future reference

Timeframe: 1-2 weeks

Documentation Requirements for NRN Property Purchase

Essential Documents Checklist

Personal Documents

- NRN Identification Card

- Purpose: Proof of NRN status

- Format: Original

- Validity: 5 years

- Nepalese Citizenship Certificate

- Purpose: Proof of former citizenship

- Format: Original copy

- Validity: Lifetime

- Foreign Passport

- Purpose: Current identification

- Format: Original + copy

- Validity: Validity period

- Recent Photographs

- Purpose: Identification purposes

- Format: Passport size

- Validity: 6 months

- Signature Verification

- Purpose: Document authentication

- Format: Bank-verified

- Validity: 6 months

Property Documents

- Land Ownership Certificate

- Purpose: Proof of seller's ownership

- Format: Original

- Validity: Current

- Land Map/Blueprint

- Purpose: Property boundaries

- Format: Certified copy

- Validity: Current

- Tax Clearance Certificate

- Purpose: Proof of tax compliance

- Format: Original

- Validity: 6 months

- Building Permit (if applicable)

- Purpose: Legal construction status

- Format: Original

- Validity: As per structure

- No Objection Certificate

- Purpose: From relevant authorities

- Format: Original

- Validity: 6 months

Transaction Documents

- Sale Agreement

- Purpose: Terms of transaction

- Format: Notarized

- Validity: As specified

- Transfer Deed

- Purpose: Legal transfer of ownership

- Format: Notarized

- Validity: Current

- Payment Receipts

- Purpose: Proof of payment

- Format: Original

- Validity: Current

- Bank Statements

- Purpose: Fund transfer proof

- Format: Certified

- Validity: 6 months

- Foreign Exchange Approval

- Purpose: Currency conversion proof

- Format: Original

- Validity: 6 months

Document Authentication Requirements

Document authentication is a critical aspect of the NRN property purchase process:

- Foreign-issued documents must be attested by the Nepalese embassy in the country of issuance

- Translations of non-English documents must be certified by a recognized translator

- Notarization is required for all transaction documents

- Certified copies must be verified by the issuing authority

- Digital signatures are not accepted for property transactions in Nepal

Financial Requirements and Banking Procedures

Investment Thresholds and Currency Regulations

Financial requirements for NRN property purchase include:

- Minimum investment: No specific minimum for residential properties

- Currency conversion: Must be done through authorized banking channels

- Repatriation limits: Sale proceeds can be repatriated subject to Nepal Rastra Bank regulations

- Bank account requirements: NRNs must maintain a specific account type for property transactions

Banking Procedures for NRNs

NRN banking procedures involve:

- Opening an NRN-specific account with a commercial bank in Nepal

- Obtaining foreign exchange approval from Nepal Rastra Bank

- Ensuring proper documentation for all fund transfers

- Maintaining transaction records for future reference

- Following repatriation procedures when selling the property

Payment Methods and Procedures

Accepted payment methods for property transactions include:

- Bank transfers from NRN accounts

- Demand drafts issued by commercial banks

- Cash payments (with limitations and reporting requirements)

- Banker's cheques for larger transactions

Tax Implications for NRN Property Purchase

Applicable Taxes and Rates

Tax obligations for NRN property purchase include:

- Registration Fee: 4% of property value, paid at registration.

- Stamp Duty: 0.5% of transaction value, paid at registration.

- Capital Gains Tax: 5-10% on profit from sale, paid when selling.

- Property Tax: Variable rate based on property value, paid annually.

- Service Charge: Fixed amount set by local authority, paid at registration.

Tax Calculation Examples

Example 1: Residential Property Purchase

For a residential property valued at NPR 10,000,000:

- Registration Fee: 4% of NPR 10,000,000 = NPR 400,000

- Stamp Duty: 0.5% of NPR 10,000,000 = NPR 50,000

- Service Charge: NPR 5,000 (fixed)

- Total Initial Tax Cost: NPR 455,000

Example 2: Property Sale with Capital Gains

If the property is sold after 5 years for NPR 15,000,000:

- Capital Gains: NPR 15,000,000 - NPR 10,000,000 = NPR 5,000,000

- Capital Gains Tax: 5% of NPR 5,000,000 = NPR 250,000

- Total Tax on Sale: NPR 250,000

Tax Exemptions and Reductions

Tax benefits available to NRNs include:

- Reduced capital gains tax for properties held longer than 5 years

- Exemptions for inherited properties

- Tax credits for property improvements

- Special provisions for NRN investments in designated zones

Restrictions and Legal Considerations

Property Type Restrictions

NRN property restrictions include:

- Agricultural land: Requires special approval from the government

- Commercial properties: Subject to additional regulations

- Properties in restricted areas: Near borders or security zones

- Cultural heritage sites: Special permissions required

- Forest land: Generally prohibited for private ownership

Legal Considerations and Pitfalls

Key legal considerations for NRN property purchase:

- Title verification is crucial to avoid disputes

- Succession planning must consider both Nepalese and foreign laws

- Repatriation restrictions may apply to property sale proceeds

- Dual citizenship implications may affect property rights

- Local regulations may vary by municipality or district

Recent Legal Developments

Recent changes to NRN property regulations include:

- Streamlined procedures for NRN property registration

- Digital initiatives for document verification

- Enhanced protections for NRN property rights

- Updated tax structures for NRN transactions

- Simplified repatriation processes for investment returns

Data Lists and Summaries

Complete Property Purchase Timeline

- Phase 1: Pre-Purchase

- NRN status verification: 2-4 weeks (Potential delays: Documentation issues)

- Property selection and due diligence: 2-6 weeks (Potential delays: Title disputes)

- Financial arrangements: 1-2 weeks (Potential delays: Banking procedures)

- Phase 2: Transaction

- Agreement and documentation: 1-2 weeks (Potential delays: Legal reviews)

- Tax payment and clearance: 1 week (Potential delays: Tax office delays)

- Registration and transfer: 2-4 weeks (Potential delays: Land revenue office backlog)

- Phase 3: Post-Purchase

- Compliance formalities: 1-2 weeks (Potential delays: Documentation errors)

Comprehensive Fee Structure

- Registration Fee: 4% of property value, applicable to all property transfers.

- Stamp Duty: 0.5% of transaction value, applicable to all property transfers.

- Service Charge: A fixed NPR 5,000, applicable to all property transfers.

- Legal Fees: Varies from NPR 10,000 to 50,000, depending on transaction complexity.

- Agent Commission: 1-2% of property value, if using a real estate agent.

- Documentation Fees: NPR 2,000-5,000 for obtaining certified copies.

- Bank Charges: NPR 500-2,000 for processing fund transfers.

Comparison of Property Rights: NRN vs. Foreign National

- Residential Property

- NRN Rights: Full ownership permitted.

- Foreign National Rights: Restricted ownership.

- Agricultural Land

- NRN Rights: Permitted with special approval.

- Foreign National Rights: Generally prohibited.

- Commercial Property

- NRN Rights: Full ownership permitted.

- Foreign National Rights: Limited ownership.

- Repatriation of Funds

- NRN Rights: Allowed under Nepal Rastra Bank regulations.

- Foreign National Rights: Subject to stricter restrictions.

- Inheritance Rights

- NRN Rights: Full inheritance rights.

- Foreign National Rights: Limited inheritance rights.

- Investment Limits

- NRN Rights: No specific limits generally apply.

- Foreign National Rights: Minimum investment limits may apply.

- Tax Treatment

- NRN Rights: Standard tax rates apply.

- Foreign National Rights: Tax treatment may differ.

FAQ Section

Can NRNs buy property in Nepal?

Yes, NRNs can buy property in Nepal under the Non-Resident Nepali Act, 2064 (2008). NRNs are permitted to purchase residential and commercial properties without specific investment limits. However, purchasing agricultural land requires special approval from the government. NRNs must maintain valid NRN status and comply with all documentation and procedural requirements outlined by the District Land Revenue Office and other relevant authorities.

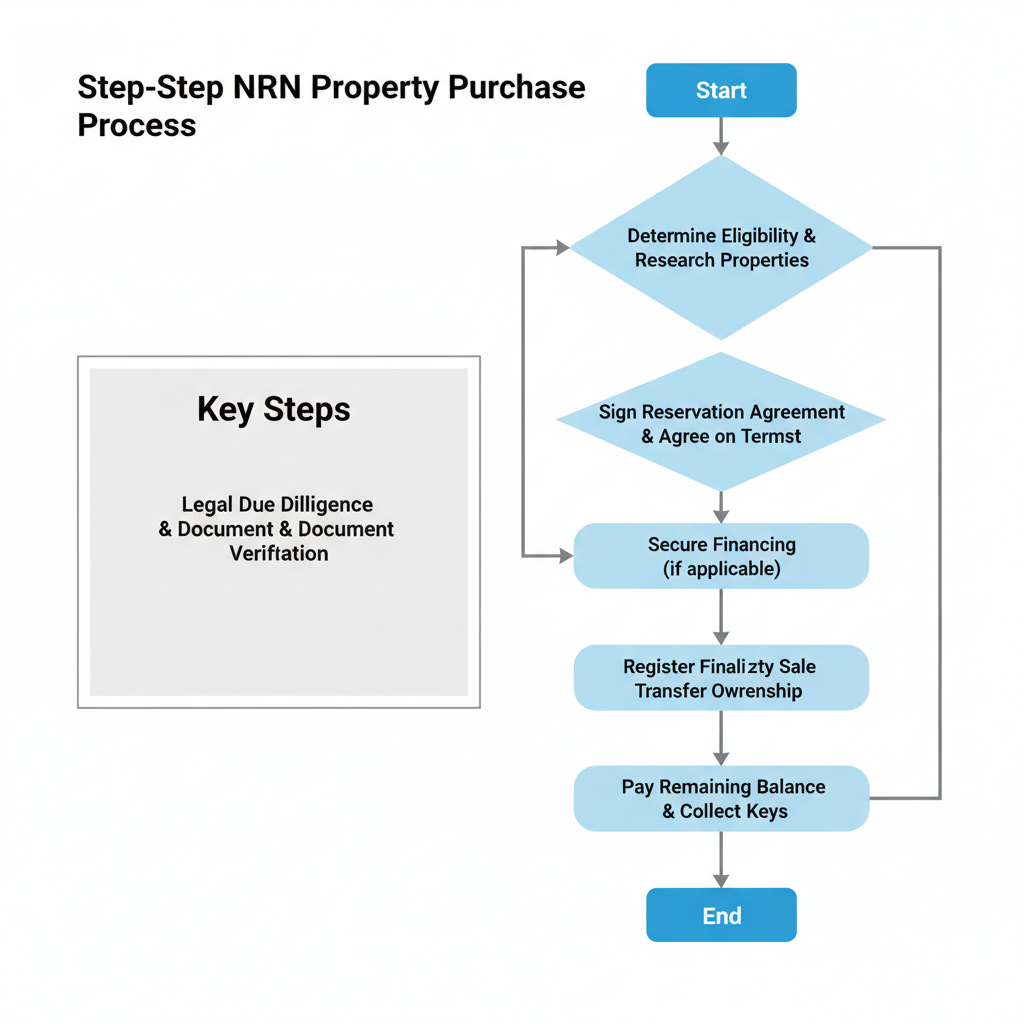

What is the step-by-step process for NRN property purchase?

The NRN property purchase process involves several key steps:

- Verify NRN status and obtain necessary identification

- Conduct thorough property due diligence

- Arrange for proper financial channels and currency conversion

- Draft and execute a sale agreement

- Pay applicable taxes and obtain clearance certificates

- Register the property transfer at the District Land Revenue Office

- Complete post-registration compliance requirements

The entire process typically takes 8-20 weeks, depending on various factors including property type, location, and documentation completeness.

What documents are required for NRN property purchase?

Required documents for NRN property purchase include:

- NRN identification card

- Nepalese citizenship certificate

- Foreign passport

- Property ownership certificate from seller

- Land map and tax clearance certificates

- Sale agreement and transfer deed

- Bank statements and foreign exchange approvals

- Photographs and signature verification

All foreign-issued documents must be attested by the Nepalese embassy in the country of issuance and translated if necessary.

How long does the property registration process take?

The property registration process for NRNs typically takes 2-4 weeks after submitting all documents to the District Land Revenue Office. However, the entire property purchase process from start to finish usually takes 8-20 weeks, depending on various factors including property type, location, and documentation completeness. Delays can occur due to bureaucratic procedures, document verification issues, or backlogs at government offices.

What are the tax implications for NRNs buying property?

Tax implications for NRNs buying property include:

- Registration fee: 4% of property value

- Stamp duty: 0.5% of transaction value

- Service charge: Fixed amount set by local authority

- Annual property tax: Based on property value and location

- Capital gains tax: 5-10% on profit when selling the property

NRNs may be eligible for certain tax benefits, including reduced capital gains tax for properties held longer than 5 years and exemptions for inherited properties.

How are property taxes calculated for NRNs?

Property taxes for NRNs are calculated based on the property's assessed value as determined by the local municipality. The calculation typically considers factors such as location, property type, size, and usage. The annual property tax rate varies by municipality but generally ranges from 0.1% to 1% of the assessed property value. NRNs are subject to the same property tax rates as Nepalese citizens and must pay these taxes annually to maintain good standing.

What are the financial requirements and banking procedures?

Financial requirements for NRN property purchase include:

- Opening an NRN-specific bank account in Nepal

- Obtaining foreign exchange approval from Nepal Rastra Bank

- Ensuring funds are transferred through authorized banking channels

- Maintaining proper documentation for all transactions

- Setting aside funds for taxes, registration fees, and other charges

NRNs must follow specific banking procedures, including proper documentation for fund transfers and compliance with foreign exchange regulations.

Are there restrictions on property types NRNs can purchase?

Yes, there are restrictions on property types that NRNs can purchase. NRNs can freely buy residential and commercial properties without specific investment limits. However, purchasing agricultural land requires special approval from the government. Additionally, properties in restricted areas (such as near borders or security zones), cultural heritage sites, and forest land may have special requirements or be prohibited for private ownership.

What is the difference between NRN and foreign national property rights?

The difference between NRN and foreign national property rights in Nepal is significant. NRNs have broader property ownership rights, including the ability to purchase residential and commercial properties without specific investment limits. Foreign nationals face more restrictions, typically limited to purchasing apartments or condominiums in designated areas and requiring special approval for other property types. NRNs also have more favorable repatriation rights for funds from property sales compared to foreign nationals.

How can NRNs repatriate funds from property sales?

NRNs can repatriate funds from property sales by following Nepal Rastra Bank's foreign exchange regulations. The process typically involves:

- Obtaining necessary approvals from the central bank

- Providing documentation of the original investment and sale

- Using authorized banking channels for fund transfer

- Paying applicable taxes before repatriation

- Following specific procedures for currency conversion

The amount that can be repatriated may be subject to certain limitations and requires proper documentation of the transaction history.

Conclusion

The NRN property purchase process in Nepal involves specific legal requirements, documentation procedures, and financial considerations that must be carefully navigated. By understanding the legal framework under the Non-Resident Nepali Act, 2064 (2008) and following the step-by-step process outlined in this guide, NRNs can successfully acquire property in Nepal while ensuring compliance with all applicable laws and regulations.

This comprehensive guide addresses all aspects of the NRN property buying journey, from initial eligibility verification through final registration and post-purchase compliance. However, given the complexity of property transactions and the potential for changes in regulations, it is strongly recommended that NRNs seek professional legal advice from qualified Nepalese attorneys specializing in property law.

For specific queries or assistance with your property purchase, consider contacting the Non-Resident Nepali Association, the Department of Land Reform and Management, or a reputable legal firm with expertise in NRN property transactions. These resources can provide personalized guidance based on your specific circumstances and the latest regulatory requirements.

a