How to Incorporate a Company in Nepal as a Foreigner

The process to incorporate a company in Nepal as a foreigner is governed by specific foreign direct investment (FDI) laws. For international entrepreneurs, the Himalayan republic offers immense opportunities. However, the legal landscape is navigated only through strict adherence to the Companies Act 2063 (2017) and the Foreign Investment and Technology Transfer Act (FITTA). This guide is designed to ensure that the company registration in Nepal is understood clearly. Furthermore, high SEO strategies have been employed to ensure this information is found easily.

By reading this comprehensive blog, a clear roadmap for foreign company incorporation in Nepal is provided. Every legal nuance is detailed to outperform other resources. The objective is to facilitate smooth entry into the Nepalese market for global investors.

Why Incorporate a Company in Nepal as a Foreigner?

Nepal’s strategic location between two economic giants, India and China, is often highlighted. Additionally, the liberalization of the economy has been pursued by the government. Foreign Direct Investment in Nepal is now encouraged in various sectors such as energy, tourism, IT, and manufacturing.

Key benefits are sought by investors when incorporating a business in Nepal:

- Access to a rapidly growing domestic market is granted.

- Bilateral investment protection treaties are enjoyed.

- Repatriation of profits and dividends is ensured (subject to regulations).

Legal Framework for Foreign Investment in Nepal

Before registration is initiated, the legal framework must be comprehended. The primary legislation is the Foreign Investment and Technology Transfer Act (FITTA), 2075 (2019). Under this act, foreign investment is defined as investment made in shares, equities, or loans by a foreign investor.

Furthermore, the Company Act 2063 regulates the formation and operation of companies. The Department of Industry (DOI) is the primary government body where foreign company registration in Nepal is processed. For certain sectors, approval from specific sectoral ministries is also required. Consequently, understanding these laws is crucial for compliance.

Pre-Incorporation Requirements for Foreign Investors

Specific prerequisites must be met before an application is filed.

1. Minimum Capital Investment

A minimum capital requirement is mandated by the Department of Industry (DOI).

- For FDI in Nepal, generally, a minimum investment of NPR 50,00,00,000 (Five Crore) is required for large-scale industries.

- However, for medium and small industries, and technology-based start-ups, the threshold is lower (e.g., NPR 20,00,00,000 or NPR 50,00,000 depending on the industry classification).

- Note: Exception is provided for the tourism and hospitality sectors in specific regions.

2. Visa and Business Status

A foreign investor must possess a valid Business Visa or an Investor Visa. Initially, a business visa is granted upon the approval of the Foreign Direct Investment (FDI) proposal.

3. Foreign Investment Approval

Prior to company registration, Foreign Direct Investment (FDI) approval must be obtained from the DOI. Without this, the Office of Company Registrar (OCR) will not process the application.

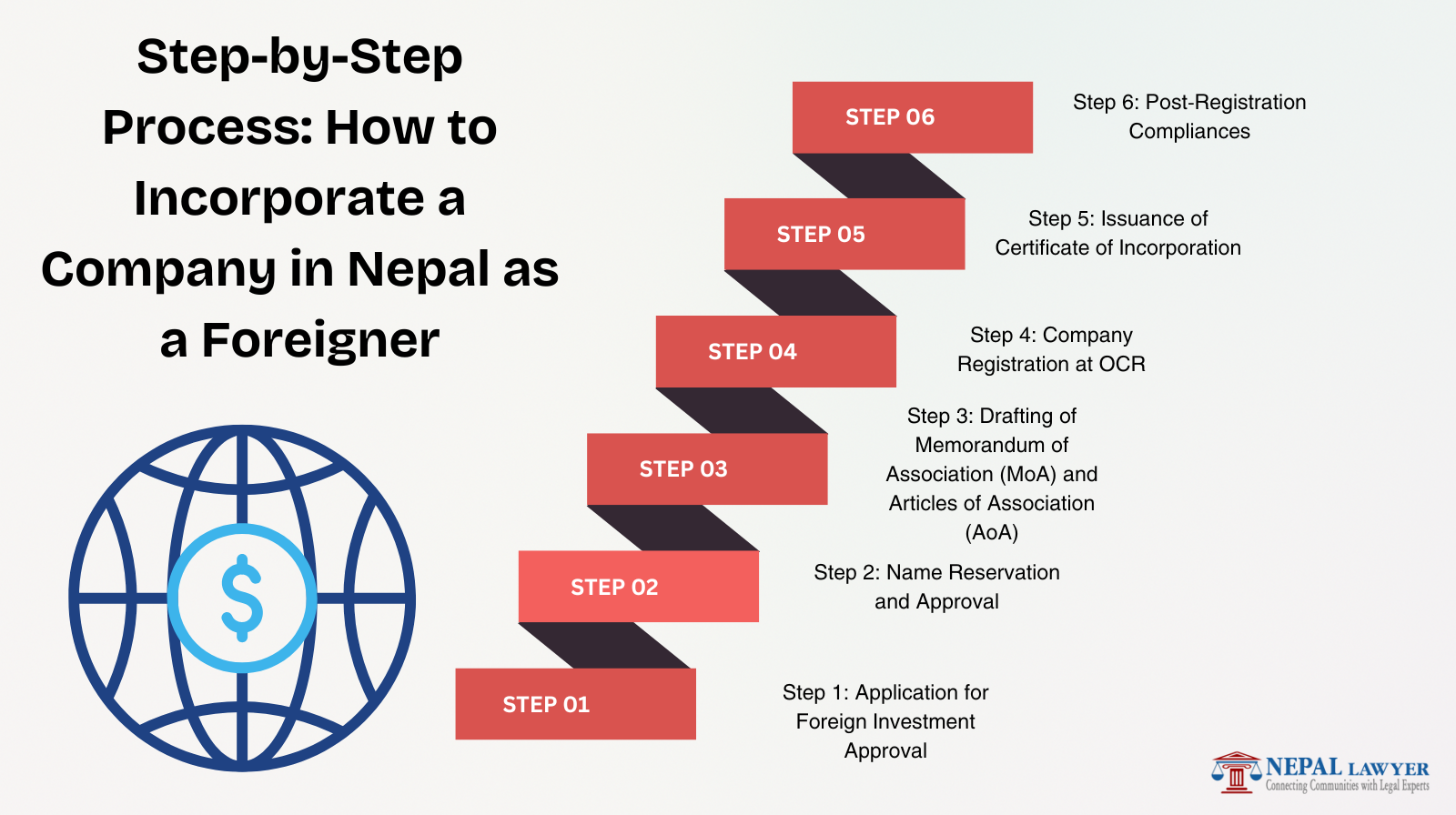

Step-by-Step Process: How to Incorporate a Company in Nepal as a Foreigner

The procedure to incorporate a company in Nepal as a foreigner is sequential. Deviation from this order results in delays.

Step 1: Application for Foreign Investment Approval

First, an application is submitted to the Department of Industry (DOI). The proposed project, its cost, the foreign investment amount, and the source of funds are detailed in this application. Additionally, a project report (PR) is required.

- Documents Required:

- Copy of the passport of the foreign investor.

- Brief profile of the foreign company/investor.

- Project Report (PR).

- Board Resolution of the foreign company authorizing the investment.

Step 2: Name Reservation and Approval

Once the FDI application is received, a name is reserved for the company. An online application is submitted to the Office of Company Registrar (OCR) via the ecompany portal. The name must be unique and not resemble existing entities. Usually, three name options are suggested.

Step 3: Drafting of Memorandum of Association (MoA) and Articles of Association (AoA)

The Memorandum of Association (MoA) and Articles of Association (AoA) define the company's constitution. These documents are drafted by a legal expert. The objectives of the company, the share structure, and the operational rules are outlined here. Notarization of these documents is performed.

Step 4: Company Registration at OCR

After FDI approval is granted, the registration process at the Office of Company Registrar (OCR) is initiated. The following steps are taken:

- Submission of the MoA and AoA.

- Submission of the FDI approval letter from the DOI.

- Payment of government registration fees.

Step 5: Issuance of Certificate of Incorporation

If all documents are found to be in order, a Certificate of Incorporation is issued by the OCR. This document signifies the legal birth of the company.

Step 6: Post-Registration Compliances

Following incorporation, several compliances are fulfilled:

- PAN/VAT Registration: The company is registered for the Permanent Account Number (PAN) and Value Added Tax (VAT) at the Inland Revenue Department (IRD).

- Bank Account: A corporate bank account is opened in a commercial bank in Nepal. The capital amount is to be remitted here.

- Social Security Fund: Registration with the Social Security Fund (SSF) is completed for employee welfare.

Documents Checklist for Foreign Company Registration in Nepal

To ensure a smooth process, a checklist is provided below. All documents must be notarized and translated into English (if not originally in English).

|

Document Name |

Description |

Authority |

|

Passport Copies |

Valid passport of all foreign directors/investors. |

DOI / OCR |

|

Board Resolution |

Resolution approving investment in Nepal and appointing local representatives. |

DOI / OCR |

|

FDI Application Form |

Duly filled application form for Foreign Direct Investment. |

DOI |

|

Project Report (PR) |

Detailed report on the business model, financials, and operations. |

DOI |

|

MoA and AoA |

Drafted memorandum and articles of association. |

OCR |

|

Citizenship Copy |

Citizenship of Nepalese director/shareholder (if any). |

OCR |

|

Power of Attorney |

If a representative is appointed on behalf of the foreign investor. |

Notary Public |

Capital Structure and Ownership in Nepal

Understanding ownership is vital when learning how to incorporate a company in Nepal as a foreigner.

Types of Companies Allowed

Generally, the following entities are incorporated by foreigners:

- Private Limited Company: Most common structure. Liability is limited.

- Public Limited Company: Required if shares are offered to the public.

- Branch Office: An extension of the foreign parent company.

- Liaison Office: Established for promotional activities only; no commercial trading is allowed.

Shareholding Pattern

In most sectors, 100% foreign ownership is permitted. However, specific sectors like defense, ammunition, and explosives are restricted. Furthermore, cottage and small-scale industries are reserved solely for Nepalese nationals.

Table: Minimum Investment Thresholds (Approximate):

|

Industry Type |

Minimum Investment (NPR) |

Remarks |

|

Large Scale Industry |

50,00,00,000 |

High capital, high employment. |

|

Medium Scale Industry |

20,00,00,000 |

Moderate capital. |

|

Technology/Service-based |

50,00,000 |

Often lower threshold applies. |

|

Tourism/Hospitality |

Varies |

Depends on location (e.g., rural vs. Kathmandu). |

Timeline for Company Incorporation in Nepal

The timeline is often queried by investors. While the government aims for efficiency, bureaucratic procedures are involved.

|

Phase |

Estimated Time |

|

FDI Approval (DOI) |

15 - 20 Business Days |

|

Name Reservation |

1 - 2 Days |

|

Company Registration (OCR) |

5 - 7 Business Days |

|

PAN/VAT Registration |

2 - 3 Days |

|

Total Estimated Time |

3 - 4 Weeks |

Note: Delays may occur if additional documents are requested by the Department of Industry.

Taxation and Repatriation of Funds

Tax compliance is strictly monitored.

Corporate Tax Rates

- For general industries, the corporate tax rate is 25%.

- For industries in specified priority sectors or special economic zones, a concessional rate of 20% is applicable.

- For banks, insurance companies, and financial institutions, the rate is 30%.

Repatriation of Profits

The Foreign Investment and Technology Transfer Act guarantees that dividends and capital can be repatriated. However, taxes must be cleared before repatriation is initiated. A 5% tax on dividends is generally deducted at source.

Challenges and Common Pitfalls

While incorporating a business in Nepal is rewarding, challenges are encountered.

- Bureaucratic Red Tape: Multiple layers of approvals can slow the process.

- Currency Restrictions: The Nepalese Rupee (NPR) is pegged to the Indian Rupee (INR). Foreign exchange regulations are strict regarding the inflow of investment capital.

- Policy Instability: Frequent changes in fiscal policy and tax laws are observed.

Therefore, local legal counsel is highly recommended to navigate these hurdles.

Conclusion

The journey to incorporate a company in Nepal as a foreigner is methodical. By securing FDI approval, registering with the OCR, and complying with tax laws, a successful business entity is established. Nepal’s potential is vast, and the legal framework is designed to facilitate foreign investment.

Call to Action: Are you ready to start your business in Nepal? Contact our expert legal team today for a seamless consultation and company registration process. Let your investment journey begin with the right legal foundation.

Frequently Asked Questions (FAQs)

Here, the most common queries regarding foreign company registration in Nepal are addressed.

- Can a foreigner own 100% of a company in Nepal? Yes, in most sectors, 100% foreign ownership is permitted. However, restricted sectors like defense, personal security services, and cottage industries are reserved for Nepalese citizens.

- What is the minimum investment required for a foreigner in Nepal? Generally, a minimum investment of NPR 50,00,00,000 is required for large industries. However, for technology-based services and smaller industries, the threshold is significantly lower (often NPR 50,00,000 to NPR 20,00,00,000). Verification is required via the Department of Industry.

- How long does it take to register a company in Nepal? The entire process, from FDI application to final PAN registration, typically takes between 3 to 4 weeks.

- What is the FDI limit in Nepal? There is no upper cap on Foreign Direct Investment. However, a minimum limit is defined for industry classification.

- Is a physical presence required for company registration in Nepal? While documents can be submitted via a representative, a visit to Nepal is recommended for opening a bank account and biometric verification. A Business Visa is required for the stay.

- What taxes are applicable to foreign companies in Nepal? Foreign companies are taxed at the standard corporate rate of 25%. Special industries may qualify for lower rates. Dividend repatriation is taxed at 5%

References

- Office of Company Registrar (OCR), Nepal - http://www.ocr.gov.np/ (Official body for company registration).

- Department of Industry (DOI), Nepal - https://doi.gov.np/ (Primary body for FDI approval).

- Foreign Investment and Technology Transfer Act (FITTA) - http://www.doind.gov.np/acts-regulations (Legal framework).

- Inland Revenue Department (IRD), Nepal - https://ird.gov.np/ (Tax compliance).

- World Bank Doing Business Report - https://www.worldbank.org/ (International context on business environment).

- Investment Board Nepal (IBN) - https://ibn.gov.np/ (For large-scale projects).

- Nepal Law Commission - http://www.lawcommission.gov.np/ (Legal repository).