Introduction

Foreign Direct Investment serves as a catalyst for Nepal's economic transformation, contributing significantly to employment generation and technology transfer. Understanding the intricate legal framework becomes essential for international investors seeking opportunities in Nepal's emerging markets. This comprehensive guide navigates through the complex regulatory landscape, administrative procedures, and strategic considerations that shape foreign investment decisions in Nepal.

What is Foreign Direct Investment in Nepal?

Foreign Direct Investment represents capital investment made by non-resident entities or individuals into Nepali businesses, involving management control and long-term business interests. The Foreign Investment and Technology Transfer Act (FITTA) 2019 governs these investments, establishing clear parameters for foreign participation across various sectors.

Key Components of FDI in Nepal:

- Equity Investment: Direct ownership stake in Nepali companies

- Reinvested Earnings: Profits channeled back into business operations

- Loan Investment: Inter-company lending between parent and subsidiary

- Technology Transfer: Knowledge and technical expertise sharing

How to Start FDI Process in Nepal: Step-by-Step Guide

The investment journey begins with careful planning and understanding of regulatory requirements. Foreign investors must navigate through multiple administrative layers, each serving specific functions in the approval process.

Phase 1: Pre-Investment Preparation

- Sector Analysis: Identify permitted investment areas under negative list approach

- Legal Structure Selection: Choose between branch office, liaison office, or incorporated company

- Investment Threshold Assessment: Ensure minimum investment requirements are met

- Documentation Preparation: Compile required certificates and legal documents

Phase 2: Application and Approval

The approval process varies based on investment size and sector, involving different administrative bodies at various stages.

Administrative Bodies and Their Roles

Department of Industry (DOI)

The Department of Industry functions as the primary regulatory body for foreign investments below NPR 6 billion. Their responsibilities encompass:

|

DOI Functions |

Description |

|

Initial Screening |

Reviews investment proposals for compliance |

|

License Issuance |

Grants operational permits for approved investments |

|

Monitoring |

Tracks investment implementation progress |

|

Facilitation |

Provides guidance throughout investment lifecycle |

|

Compliance Verification |

Ensures adherence to FITTA provisions |

Nepal Rastra Bank (NRB)

Nepal's central bank plays a crucial role in foreign exchange management and investment facilitation:

- Foreign Exchange Approval: Authorizes currency transactions and repatriation

- Investment Recording: Maintains database of foreign investments

- Banking Facilitation: Guides banking procedures for foreign investors

- Monitoring Capital Flows: Tracks inward and outward investment movements

Investment Board Nepal (IBN)

For large-scale investments exceeding NPR 6 billion, the Investment Board Nepal assumes primary responsibility:

|

IBN Jurisdiction |

Investment Threshold |

|

Manufacturing |

Above NPR 6 billion |

|

Infrastructure |

Above NPR 6 billion |

|

Tourism |

Above NPR 6 billion |

|

Strategic Sectors |

As designated by government |

What is the Minimum Investment Threshold for FDI?

The Foreign Investment and Technology Transfer Act 2019 establishes clear minimum investment requirements:

Current FDI Thresholds:

|

Investment Type |

Minimum Amount |

|

Cash Investment |

NPR 5 million (approximately USD 38,000) |

|

Single Investor |

NPR 5 million per entity |

|

Technology Transfer |

No minimum threshold |

|

Venture Capital |

NPR 10 million |

These thresholds ensure meaningful economic contribution while remaining accessible to genuine foreign investors.

Investment Law Framework in Nepal

Nepal's investment regime operates under multiple legislative instruments, creating a comprehensive legal framework:

Primary Legislation:

- FITTA 2019: Core foreign investment law

- Companies Act 2006: Corporate governance framework

- Industrial Enterprises Act 2020: Industrial promotion provisions

- Income Tax Act 2002: Taxation framework

Sector-Specific Regulations:

Different sectors maintain additional regulatory requirements, particularly in banking, insurance, telecommunications, and hydropower sectors.

How to Obtain FDI Approval: Detailed Procedure

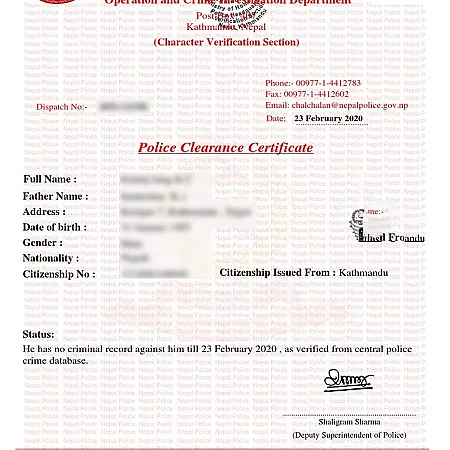

Step 1: Company Registration (7-10 days)

Required documents include:

- Memorandum of Association

- Articles of Association

- Power of Attorney

- Board Resolution from parent company

- Certificate of Incorporation (apostilled)

Step 2: Investment Approval (15-30 days)

The approval timeline depends on investment size and completeness of documentation:

- Application Submission: File through online portal or physical submission

- Initial Review: DOI/IBN conducts preliminary assessment

- Inter-ministerial Consultation: Relevant ministries provide sector-specific clearance

- Final Approval: Investment approval letter issued

- Industry Registration: Obtain operational licenses

Step 3: Foreign Exchange Approval (7-14 days)

Nepal Rastra Bank processes foreign exchange applications upon presentation of:

- Investment approval letter

- Bank account details

- Capital import declaration

- Source of fund documentation

Company Law Compliance for Foreign Investors

Foreign investors must navigate Nepal's company law requirements, which mandate specific compliance measures:

Corporate Structure Requirements:

|

Entity Type |

Foreign Ownership |

Minimum Directors |

Capital Requirement |

|

Private Limited |

Up to 100% |

1 |

NPR 5 million |

|

Public Limited |

Up to 100% |

3 |

NPR 10 million |

|

Branch Office |

100% |

1 (Representative) |

As per parent |

Ongoing Compliance Obligations:

- Annual General Meetings within 6 months of fiscal year-end

- Financial statement filing with regulatory authorities

- Tax clearance certificates renewal

- Investment monitoring reports submission

Sector-Specific FDI Regulations

Different economic sectors maintain varying degrees of openness to foreign investment:

Open Sectors (100% FDI Allowed):

- Manufacturing (except defense-related)

- Energy and hydropower

- Tourism and hospitality

- Information technology

- Agriculture and forestry

Restricted Sectors:

- Banking (up to 80%)

- Insurance (up to 80%)

- Telecommunications (up to 80%)

- Media (up to 49%)

Prohibited Sectors:

- Personal service businesses

- Real estate (except construction)

- Retail trading (with exceptions)

- Consultancy services (except high-tech)

Types of Investment Protection

Nepal provides various mechanisms to protect foreign investments:

Legal Protections:

- Non-discrimination: Equal treatment with domestic investors

- Expropriation Protection: Compensation guarantees against nationalization

- Dispute Resolution: Access to international arbitration

- Repatriation Rights: Guaranteed profit and capital repatriation

Bilateral Investment Protection:

Nepal maintains Bilateral Investment Promotion and Protection Agreements (BIPPA) with several countries, offering additional safeguards.

Investment Incentives and Facilities

The government provides various incentives to attract foreign investment:

|

Incentive Type |

Description |

Eligibility |

|

Income Tax Holiday |

Up to 10 years |

Priority sectors |

|

Customs Duty Exemption |

On machinery import |

Manufacturing units |

|

VAT Refund |

On exports |

Export-oriented industries |

|

Industrial Estate Facilities |

Subsidized infrastructure |

All eligible industries |

Repatriation Procedures and Guidelines

Foreign investors enjoy guaranteed repatriation rights under FITTA 2019:

Repatriable Items:

- Dividend payments (after tax)

- Principal and interest on foreign loans

- Technology transfer fees and royalties

- Sale proceeds from investment liquidation

Repatriation Process:

- Tax clearance certificate obtainment

- Audited financial statements submission

- NRB approval application

- Banking channel transfer execution

Recent Regulatory Updates and Changes

The investment landscape continues evolving with recent amendments:

2024-2025 Key Changes:

- Streamlined single-window service implementation

- Digital documentation acceptance

- Reduced processing timelines

- Enhanced sectoral clarity

Common Challenges and Solutions

Foreign investors frequently encounter specific challenges:

|

Challenge |

Solution Approach |

|

Bureaucratic Delays |

Engage licensed intermediaries |

|

Documentation Requirements |

Prepare comprehensive packages upfront |

|

Regulatory Ambiguity |

Seek formal clarifications from authorities |

|

Banking Procedures |

Establish relationships with major banks |

Frequently Asked Questions

What is the current FDI policy in Nepal?

Nepal follows a negative list approach where all sectors remain open unless specifically restricted or prohibited. The FITTA 2019 serves as the primary governing legislation, promoting foreign investment through simplified procedures and enhanced investor protection measures.

How long does FDI approval take in Nepal?

Standard FDI approval typically requires 30-45 days from complete application submission. Investments below NPR 6 billion processed through DOI generally receive faster approval compared to large-scale investments requiring IBN assessment.

Can foreign investors own 100% of a Nepali company?

Yes, foreign investors can maintain 100% ownership in most sectors. However, certain strategic sectors like banking, insurance, and telecommunications impose ownership caps ranging from 49% to 80%.

What documents need apostille authentication?

Corporate documents originating abroad require apostille authentication, including: Certificate of Incorporation, Board Resolutions, Power of Attorney, and Financial Statements. Countries not party to Apostille Convention must pursue consular authentication.

How to transfer profits from Nepal?

Profit repatriation follows a structured process: obtain tax clearance, submit audited financials to NRB, secure repatriation approval, and execute transfer through authorized banking channels. No restrictions exist on profit repatriation after tax compliance.

What is the role of local partners in FDI?

While not mandatory in most sectors, local partners provide valuable insights into market dynamics, regulatory navigation, and cultural considerations. Joint ventures often expedite administrative processes and market penetration.

How does technology transfer approval work?

Technology transfer agreements require separate DOI approval, demonstrating genuine technology transfer, training provisions, and reasonable fee structures. No minimum investment threshold applies to pure technology transfer arrangements.

What tax benefits do foreign investors receive?

Priority sector investments enjoy income tax holidays up to 10 years, customs duty exemptions on machinery imports, and accelerated depreciation allowances. Export-oriented industries receive additional VAT refund facilities.

Conclusion

Successfully navigating Nepal's FDI landscape requires comprehensive understanding of regulatory frameworks, administrative procedures, and strategic considerations. The country's improving investment climate, supported by progressive legislation and streamlined processes, creates favorable conditions for foreign investors. By following established procedures, maintaining compliance standards, and leveraging available incentives, foreign investors can effectively establish and grow their presence in Nepal's dynamic market.

The convergence of legal reforms, administrative improvements, and economic opportunities positions Nepal as an increasingly attractive investment destination. Foreign investors who approach the market with proper preparation, regulatory compliance, and long-term commitment find substantial opportunities for growth and contribution to Nepal's economic development journey.