Legal Framework Governing Tourism Enterprises in Nepal

The hotel and tourism business in Nepal is regulated by multiple legislative instruments designed to ensure systematic development of the hospitality sector. The Tourism Act 2035 (1978) serves as the primary legislation, while the Industrial Enterprise Act 2076 (2020) and Foreign Investment and Technology Transfer Act 2075 (2019) provide complementary provisions. These laws were established to create a structured approach toward tourism development while protecting national interests.

For any tourism business in Nepal, registration with the Department of Tourism is mandatory under Section 3 of the Tourism Act. Furthermore, hotels must obtain classification certificates per the Hotel Management and Operation Directives 2074 (2017). The Department of Tourism has been empowered to issue licenses for various tourism activities including trekking, expedition, and hotel operations. Consequently, compliance with these regulations is essential before commencing operations.

Step-by-Step Registration Process for Tourism Ventures

The systematic process by which hotel and tourism business registration in Nepal is completed involves several sequential steps. Detailed below is the procedural framework that must be followed:

|

Step |

Procedure |

Authority |

Estimated Time |

Required Documents |

|

1 |

Company registration at Office of Company Registrar |

OCR |

1-3 days |

Citizenship, MOA, AOA |

|

2 |

PAN/VAT registration at Inland Revenue Department |

IRD |

1 day |

Company registration, blueprint |

|

3 |

Tourism license application |

Department of Tourism |

7-14 days |

Bank guarantee, tax clearance |

|

4 |

Hotel classification (if applicable) |

Ministry of Tourism |

30 days |

Infrastructure inspection |

|

5 |

Municipality operating license |

Local authority |

3-5 days |

Fire safety, building approval |

Firstly, company incorporation must be completed under the Companies Act 2063. Subsequently, tax registration is obtained from the Inland Revenue Department. Moreover, the tourism license application requires submission of a bank guarantee amounting to NPR 500,000 for trekking agencies and NPR 2,000,000 for hotels. The application fee is determined by business type and scale.

Investment Structure and Capital Requirements

Significant financial commitments are required for tourism investment in Nepal. The minimum capital threshold varies based on business classification:

- Five-star hotel: NPR 500 million minimum investment

- Three-star hotel: NPR 100 million minimum investment

- Budget hotel: NPR 10 million minimum investment

- Trekking agency: NPR 2 million minimum investment

- Travel agency: NPR 1 million minimum investment

Foreign investment up to 100% is permitted in hotel construction and operation under the automatic route for projects exceeding NPR 2 billion. Additionally, repatriation of profits and dividends is allowed under the Foreign Investment and Technology Transfer Act. However, investment below NPR 2 billion requires approval from the Investment Board Nepal or Department of Industry.

Classification Standards for Hotel Establishments

The classification system by which hotels in Nepal are categorized ensures quality standardization. The Ministry of Culture, Tourism and Civil Aviation implements this framework:

|

Star Rating |

Minimum Rooms |

Required Facilities |

Annual Fee (NPR) |

|

Five Star |

100 |

Swimming pool, spa, multiple restaurants |

150,000 |

|

Four Star |

50 |

Conference hall, business center |

100,000 |

|

Three Star |

30 |

Restaurant, room service |

75,000 |

|

Two Star |

20 |

Basic dining, 24-hour reception |

50,000 |

|

One Star |

10 |

Clean rooms, basic amenities |

25,000 |

Inspection is conducted by a committee comprising tourism officials and hospitality experts. Standards related to fire safety, sanitation, and accessibility are strictly enforced. Furthermore, periodic renewal is required every five years, and failure to maintain standards results in downgrading or license cancellation.

Taxation and Compliance Obligations

Multiple tax obligations must be fulfilled by hotel and tourism business operators in Nepal. The Inland Revenue Department mandates the following:

- Value Added Tax (VAT): 13% on services provided

- Corporate Income Tax: 25% for hospitality businesses

- Tourism Service Fee: 2% on room charges collected from tourists

- Corporate Social Responsibility: 1% of net profit for community development

Additionally, employees must be enrolled in social security schemes as per the Contribution Based Social Security Act 2074. Monthly tax returns and annual audits are compulsory. Nevertheless, tax incentives are provided for investments in undeveloped tourist regions such as Karnali Province and Far-West Province, where income tax exemptions up to 10 years may be granted.

Market Opportunities and Sectoral Challenges

The tourism sector in Nepal presents substantial opportunities despite inherent challenges. In 2023, tourist arrivals reached 1.01 million, generating $1.2 billion in revenue. The Nepal Tourism Strategy 2022-2032 targets 2.5 million annual visitors by 2032.

Opportunities:

- Adventure tourism: Trekking, mountaineering, paragliding

- Cultural tourism: Heritage sites, festivals, religious tourism

- Medical tourism: Ayurveda, wellness centers

- MICE tourism: Meetings, incentives, conferences, exhibitions

Challenges:

- Seasonal fluctuations: 70% of visitors arrive during October-November

- Infrastructure gaps: Limited connectivity in remote areas

- Skilled labor shortage: Hospitality training institutes are inadequate

- Policy inconsistency: Frequent regulatory changes create uncertainty

Nevertheless, the Visit Nepal 2025 campaign is being promoted by the government to boost arrivals. Moreover, new international airports in Pokhara and Lumbini are expected to enhance accessibility.

Frequently Asked Questions

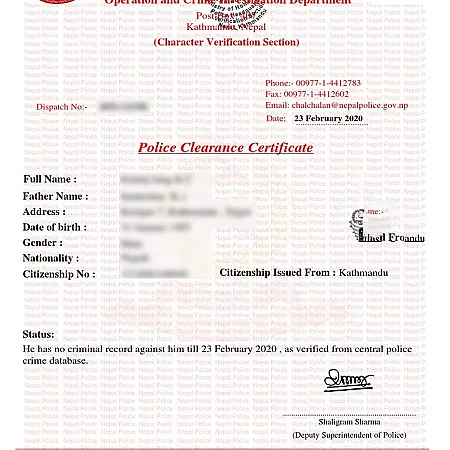

What documents are required for tourism license in Nepal?

Citizenship certificates, company registration, PAN/VAT certificate, bank guarantee, tax clearance, hotel blueprint (for accommodation), and police clearance of promoters must be submitted. The application is processed by the Department of Tourism within 7-14 working days.

How much does hotel registration cost in Nepal?

Company registration costs NPR 10,000-50,000 depending on capital. Tourism license fee ranges from NPR 25,000 to 150,000 annually based on classification. Additionally, a bank guarantee of NPR 500,000-2,000,000 is required, which remains refundable.

Can foreigners own hotels in Nepal?

Yes, foreign investment up to 100% is permitted in hotel construction. Projects above NPR 2 billion receive automatic approval; smaller investments require Department of Industry approval. However, land ownership by foreigners is prohibited; long-term lease up to 50 years is allowed.

How long does hotel classification take?

The classification process typically requires 30 days from application submission. A technical committee conducts physical inspection of infrastructure, amenities, and service standards. Temporary classification may be granted pending minor improvements.

What is the tourist arrival trend in Nepal?

Tourist arrivals have shown consistent growth, reaching 1.01 million in 2023 from 150,000 in 2020. The average length of stay is 13 days, with per capita spending estimated at $1,186. The government targets 2.5 million arrivals by 2032.

Are tax incentives available for tourism businesses?

Yes, income tax exemptions up to 10 years are provided for hotels established in Karnali and Far-West provinces. Additionally, VAT exemptions are granted for souvenir exports, and customs duty concessions are available for imported hotel equipment.

What is the procedure for online application?

The Department of Tourism's online portal (tourismdepartment.gov.np) enables digital submission. However, physical verification of documents remains mandatory. The process includes registration, form filling, document upload, fee payment, and final approval.

How are trekking agencies regulated differently?

Trekking agencies require additional registration with Trekking Agencies Association of Nepal (TAAN). Furthermore, they must employ licensed trekking guides and follow strict safety protocols. Separate insurance coverage for trekkers is mandatory.

What are CSR obligations for hotels?

Hotels earning over NPR 2.5 million annually must allocate 1% of net profit to CSR activities. Projects must be implemented in local communities focusing on education, health, or infrastructure development. Annual reports must be submitted to the Department of Tourism.

Can existing buildings be converted to hotels?

Yes, conversion is permitted subject to structural safety certification and compliance with hotel standards. However, classification depends on facilities provided, not just building age. Heritage buildings may receive special consideration for architectural preservation.

Conclusion and Strategic Recommendation

The systematic approach by which hotel and tourism business in Nepal is established requires meticulous compliance with legal frameworks and strategic financial planning. Due to Nepal's ambitious tourism targets, significant opportunities exist for qualified investors. Nevertheless, success depends on understanding local regulations, market dynamics, and cultural sensitivities.

For professional assistance with registration, classification, and compliance, experienced consultants should be consulted. The investment made in expert guidance often results in expedited approvals and avoided penalties.

Contact the Department of Tourism at 1330, Bagmati Province, Kathmandu, or visit tourismdepartment.gov.np for updated forms and circulars.

References

The information presented was compiled and prepared from authoritative sources to ensure accuracy and compliance with current regulations. The Tourism Department Nepal provides official guidelines for licensing and classification procedures. Moreover, the Ministry of Culture, Tourism and Civil Aviation publishes policy frameworks and tourism statistics. Investment regulations are detailed on the Department of Industry Nepal portal. For tax obligations, the Inland Revenue Department offers comprehensive directives. Additionally, the Nepal Rastra Bank governs foreign investment repatriation policies. Statistical data was referenced from the Nepal Tourism Board annual reports. International standards were cross-checked with World Tourism Organization guidelines. Furthermore, the Company Registrar Office Nepal provides company registration procedures. For legal interpretations, the Nepal Law Commission database was consulted. Finally, the Investment Board Nepal offers guidance for large-scale tourism projects.