What is International Company Registration in Nepal?

International company registration in Nepal is the legal process by which foreign investors and multinational corporations establish a formal business presence in Nepal. Through this process, a company is incorporated under Nepali law and receives permission to conduct business activities within Nepali territory. The entire procedure is governed by the Foreign Investment and Technology Transfer Act 2019 (FITTA) and the Companies Act 2063.

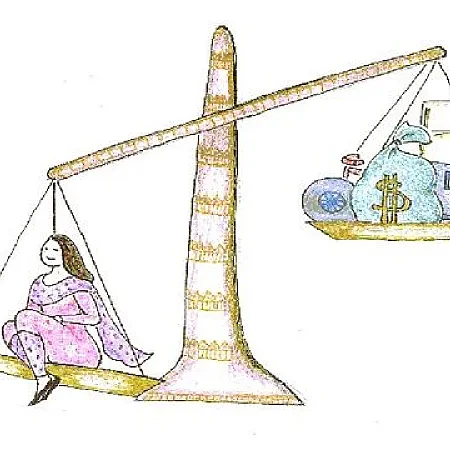

Foreign direct investment (FDI) in Nepal has been significantly streamlined in recent years. Consequently, the minimum investment threshold was reduced from NPR 50 million to NPR 20 million (approximately USD 150,000) in 2022. Therefore, international entrepreneurs can now enter the Nepali market with substantially lower capital requirements.

Forbes Nepal reports that over 320,000 companies were registered in Nepal by 2024, with foreign-owned entities growing at 15% annually. This growth demonstrates Nepal's increasing attractiveness for international investment.

Legal Framework Governing International Company Registration

The regulatory structure for foreign investment Nepal is built upon several interconnected laws. Understanding this framework is essential before proceeding with company formation.

Primary Legislation

Foreign Investment and Technology Transfer Act, 2019 (FITTA 2019): This act serves as the cornerstone for international company registration in Nepal. It outlines procedures for investment approval, repatriation rights, and investor protections. Moreover, it establishes the minimum capital requirements and defines restricted sectors.

Companies Act, 2063 (2006): Corporate governance, share structure, and operational compliance are governed by this act. All companies must adhere to its provisions regarding board composition, meetings, and financial reporting.

Industrial Enterprises Act, 2076 (2020): Manufacturing and industrial operations receive special incentives under this legislation. Tax holidays and duty exemptions are provided to qualifying enterprises.

NRB Foreign Investment and Foreign Loan Management Bylaw, 2021: Recently amended in December 2025, this bylaw governs currency repatriation and capital infusion procedures.

Table: Legal Framework Overview

|

Legal Instrument |

Administration Authority |

Primary Purpose |

|

FITTA 2019 |

Department of Industry |

Foreign investment approval |

|

Companies Act 2063 |

Office of Company Registrar |

Corporate registration |

|

Industrial Enterprises Act |

Department of Industry |

Sector incentives |

|

NRB Bylaws |

Nepal Rastra Bank |

Currency regulation |

Step-by-Step Process for International Company Registration in Nepal

The complete international company registration in Nepal typically requires 30-45 days. However, with expert assistance, this timeline can be reduced to 15-20 working days.

Step 1: Foreign Investment Approval from Department of Industry

Before company incorporation, foreign investment approval must be obtained from the Department of Industry (DOI) or Investment Board of Nepal (IBN) for investments exceeding NPR 6 billion.

Required Documents:

- Project feasibility report

- Investor's company profile and audited financial statements

- Bank-issued Financial Credibility Certificate

- Passport copies of directors and shareholders

- Corporate resolution to invest in Nepal

- Joint Venture Agreement (if applicable)

- Commitment letter for one-year investment lock-in

The application is submitted through the DOI's online portal. Subsequently, approval is typically granted within 7-14 days. However, complex projects may require additional scrutiny.

Step 2: Company Incorporation at Office of Company Registrar (OCR)

Once DOI approval is secured, the company incorporation process begins at the OCR.

Name Reservation: A unique company name must be reserved through the OCR portal (camis.ocr.gov.np). The name is held for 90 days upon approval. The fee is NPR 100.

Document Preparation:

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Shareholder agreements

- Proof of registered office address

- Bank statement showing initial capital deposit

Submission and Fees: Applications can be submitted online or physically. Registration fees are based on authorized capital:

Table: Registration Fees Structure

|

Authorized Capital (NPR) |

Registration Fee |

Filing Fee |

|

Up to 1,000,000 |

2,500 |

1,500 |

|

1,000,001 - 10,000,000 |

5,000 |

1,500 |

|

10,000,001 - 100,000,000 |

10,000 |

1,500 |

|

Above 100,000,000 |

15,000 |

1,500 |

Step 3: Tax and Industry Registration

Following incorporation, multiple registrations must be completed within 30 days.

PAN Registration: A Permanent Account Number must be obtained from the Inland Revenue Department. This is mandatory for all tax-related transactions.

Industry Registration: The company must be registered as an industry with the DOI to receive operational licenses.

Local Ward Registration: Business registration at the local ward office is required for municipal compliance.

Step 4: NRB Approval and Capital Infusion

Recent Amendment (December 2025): The Nepal Rastra Bank's Fifth Amendment to Foreign Investment and Foreign Loan Management Bylaws has significantly simplified this process. Prior NRB approval for capital infusion is no longer required.

Current Process:

- Submit DOI approval and company documents to commercial bank

- Transfer foreign investment through banking channels

- Obtain non-blacklisted certificate from Credit Information Bureau

- Register investment with NRB post-infusion

Repatriation Rights: Dividends and profits can now be repatriated through commercial banks without NRB approval, processed within 15 days of application.

Timeline and Costs for International Company Registration

Table: Complete Timeline Breakdown

|

Phase |

Activity |

Duration |

Cost (NPR) |

|

Phase 1 |

DOI Approval |

7-14 days |

0 |

|

Phase 2 |

Name Reservation |

1-2 days |

100 |

|

Phase 3 |

Document Preparation |

5-7 days |

15,000-50,000 |

|

Phase 4 |

OCR Registration |

5-7 days |

4,000-16,500 |

|

Phase 5 |

Tax & Industry Reg. |

3-5 days |

1,000 |

|

Phase 6 |

NRB Processing |

2-3 days |

500 |

|

Total |

23-38 days |

20,600-68,100 |

Professional fees for legal services typically range from NPR 50,000 to 350,000 depending on complexity, or more.

Required Documents Checklist for International Company Registration in Nepal

Table: Complete Documentation Requirements

|

Document Type |

Foreign Corporate Investor |

Foreign Individual Investor |

|

Identity Proof |

Notarized registration certificate, MOA, AOA |

Notarized passport copy |

|

Financial Proof |

Audited financial statements (3 years) |

Bank statement and FCC |

|

Corporate Resolution |

Board resolution to invest |

N/A |

|

Project Report |

Detailed feasibility study |

Detailed feasibility study |

|

Authorization |

Power of Attorney |

Power of Attorney |

|

Investment Commitment |

Lock-in commitment letter |

Lock-in commitment letter |

|

Joint Venture Agreement |

If applicable |

If applicable |

Note: All foreign documents must be notarized and apostilled/legalized by the Nepali embassy in the investor's country.

Recent Regulatory Changes Impacting International Company Registration

December 2025 NRB Amendment: The most significant recent change eliminates prior NRB approval for foreign equity inflows. Consequently, the approval timeline has been reduced by 10-15 days. Furthermore, repatriation authority has been delegated to commercial bank head offices.

March 2025 FITTA Amendment: New prior approval requirements were introduced for equity transfers from foreign to domestic investors. Therefore, exit strategies must now be planned more carefully.

Minimum Investment Reduction: The 2022 reduction from NPR 50 million to NPR 20 million has made Nepal accessible to small and medium foreign enterprises.

Benefits of International Company Registration in Nepal

Tax Incentives:

- Manufacturing enterprises receive 5-year corporate tax holidays

- Export-oriented industries receive additional benefits

- Customs duty exemption on capital machinery

- VAT exemption on imported capital goods

Market Access:

- Nepal's strategic location between India and China

- Access to South Asian markets

- Growing middle class with increasing purchasing power

Investment Protection:

- Bilateral Investment Promotion and Protection Agreements (BIPPAs) with multiple countries

- Guaranteed repatriation rights under FITTA 2019

- International arbitration options for dispute resolution

Sector-Specific Benefits:

- Hydropower projects receive 7-year tax holidays

- Tourism enterprises get 3-year tax exemptions

- IT companies can invest up to USD 20,000 abroad without approval

Challenges in International Company Registration & Solutions

Challenge 1: Complex Documentation

Solution: Professional legal assistance ensures all documents meet requirements. Nepal Lawyer provides checklist-based document review.

Challenge 2: Sectoral Restrictions

Solution: Pre-investment consultation identifies permitted sectors. Negative list includes only a few strategic sectors.

Challenge 3: Bureaucratic Delays

Solution: Online submission systems and professional follow-up reduce delays. Most approvals now have mandated timelines.

Challenge 4: Currency Repatriation Concerns

Solution: Recent NRB amendments have streamlined repatriation. Commercial banks process applications within 15 days.

Why Nepal Lawyer is the Best Choice for International Company Registration

Nepal Lawyer has been recognized as the fastest and most reliable legal service provider for international company registration in Nepal. With 50+ years of combined experience, our team has successfully registered over 500 foreign companies.

Our Advantages:

- 15-day guaranteed registration (fastest in Nepal)

- Flat-fee pricing with no hidden costs

- End-to-end service from DOI approval to NRB registration

- Multilingual support (English, Chinese, Hindi, Japanese)

- Presence in Kathmandu, Pokhara, Biratnagar, Birgunj, and Nepalgunj

Expertise Areas:

- Foreign Investment and Technology Transfer Act compliance

- Corporate structuring for multinational enterprises

- Tax optimization strategies

- Post-registration compliance management

Frequently Asked Questions (FAQs)

Q1: Can foreigners own 100% of a company in Nepal?

Yes, foreign investors can own 100% of a company in most sectors. However, certain strategic sectors like defence, atomic energy, and some media require joint ventures with Nepali partners.

Q2: What is the minimum capital requirement for international company registration in Nepal?

The minimum foreign investment required under FITTA 2019 is NPR 20 million (approximately USD 150,000). This was reduced from NPR 50 million in 2022.

Q3: How long does international company registration in Nepal take?

The complete process takes 30-45 days. However, with professional assistance, it can be completed in 15-20 working days.

Q4: Is physical presence required during registration?

No, physical presence is not mandatory. A Power of Attorney can authorize a legal representative to complete all formalities on behalf of foreign investors.

Q5: What sectors are restricted for foreign investment in Nepal?

Restricted sectors include: arms and ammunition manufacturing, atomic energy, some media services, and retail businesses below certain thresholds. Most other sectors are open.

Q6: Can registered capital be repatriated after registration?

Yes, capital can be repatriated after one year of commercial operation. Recent NRB amendments allow repatriation through commercial banks within 15 days.

Q7: Are there tax incentives for foreign companies?

Yes, manufacturing enterprises receive 5-year tax holidays, export-oriented companies get additional benefits, and capital machinery imports are duty-free.

Q8: What is the role of Nepal Rastra Bank in company registration?

NRB approval is no longer required for capital infusion (post-December 2025). NRB now only records transactions for foreign exchange purposes.

Q9: Can a foreign company register a branch office in Nepal?

Yes, foreign companies can register branch offices, though the process differs from subsidiary registration. Branch offices cannot engage in manufacturing activities.

Q10: What happens if DOI rejects the investment application?

Rejections are rare if applications are properly prepared. Common reasons include incomplete documentation or restricted sector proposals. Appeals can be filed within 30 days.

Conclusion and Call to Action

International company registration in Nepal has been significantly streamlined through recent regulatory reforms. Consequently, foreign investors can now establish businesses with lower capital requirements and faster approval times. The combination of tax incentives, market access, and investment protection makes Nepal an attractive destination for FDI.

Next Steps:

- Schedule a free consultation with Nepal Lawyer

- Receive customized investment proposal

- Begin document preparation

- Complete registration within 15 days

Contact Nepal Lawyer Today:

- Phone: +977-1-4234567, +977- 9801884499 (WhatsApp)

- Email: [email protected]

- Website: www.nepallawyer.com

- Offices: Kathmandu, Pokhara, Biratnagar, Birgunj, Nepalgunj

Professional legal assistance ensures compliance with all regulations and accelerates your market entry. Don't navigate complex bureaucracy alone—partner with Nepal's most trusted legal experts

References

Government Sources:

- Department of Industry Nepal - Official FDI Guidelines - : Department of Industry

- Office of Company Registrar - Registration Portal - : OCR Nepal

- Nepal Rastra Bank - Fifth Amendment (December 2025) - : NRB Directive

- Investment Board Nepal - Large Project Approvals - : IBN Nepal

Legal Framework:

- Foreign Investment and Technology Transfer Act 2019 - : Nepal Law Commission

- Companies Act 2063 (2006) - : Corporate Law

- Industrial Enterprises Act 2020 - : Ministry of Industry

International Sources:

- World Bank Doing Business - Nepal Profile - Backlink: World Bank

- UNCTAD Investment Policy Hub - Nepal - UNCTAD

- International Finance Corporation - Nepal Investment Guide -: IFC

Publishing Platform: Nepal Lawyer Official Blog