A business license in Nepal is mandatory before any commercial operation begins. Understanding the Nepal business license process is crucial for entrepreneurs. This guide covers every legal requirement for company registration Nepal, tourism permits, education consultancy approvals, and manpower licensing.

Table of Contents

- What is Business License in Nepal?

- Types of Business Licenses in Nepal

- Step-by-Step Process for Company Registration

- Education Consultancy License Nepal

- Travel Agency License Nepal

- Manpower License Process Nepal

- PAN & VAT Registration Requirements

- Post-License Compliance

- Fees and Timelines

- FAQs

- References

What is Business License in Nepal?

A business license in Nepal is defined as official permission granted by government authorities to conduct commercial activities. Without proper company registration in Nepal, no legal entity can be formed. The business registration process Nepal is governed by multiple statutes.

Primary Legal Framework

The business license process operates under several key legislations:

|

Legal Instrument |

Governing Body |

Application Scope |

|

Companies Act, 2063 |

Office of Company Registrar (OCR) |

All company formations |

|

Industrial Enterprises Act, 2076 |

Department of Industry |

Industrial operations |

|

Tourism Act, 1978 |

Department of Tourism |

Travel/trekking agencies |

|

Foreign Employment Act, 2064 |

Department of Foreign Employment |

Manpower agencies |

|

Education Act, 2028 |

Ministry of Education |

Consultancy services |

Types of Business Licenses in Nepal

Different business activities require specific license types in Nepal. The main categories include:

1. Company Registration Certificate

Issued by OCR Nepal, this is the foundational document for all businesses.

2. Industry Registration Certificate

Required for manufacturing and industrial enterprises under the Department of Industry Nepal.

3. Tourism License Nepal

Mandatory for travel agency license Nepal applications and trekking operations.

4. Education Consultancy License

Granted by MoEst and MOSD Nepal or provincial ministries.

5. Manpower License Nepal

Regulated by DoFE Nepal for overseas recruitment.

6. PAN Registration Certificate

Essential tax identification from IRD Nepal.

7. VAT Registration Certificate

Required for businesses exceeding NPR 5 million turnover.

8. Money Exchange License Certificate

Required by Money exchange company issued by NRB Nepal.

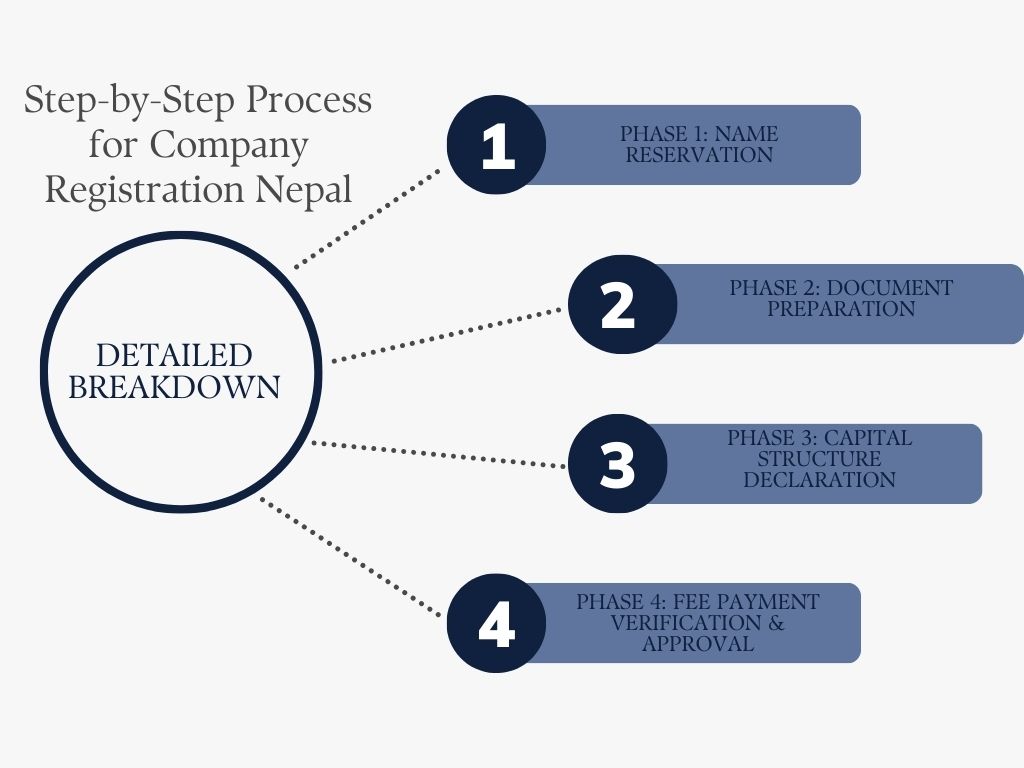

Step-by-Step Process for Company Registration Nepal

The company registration process Nepal can be completed online through camis.ocr.gov.np.

Phase 1: Name Reservation

Step 1: Access the OCR portal at ocr.gov.np

Step 2: Create user account with mobile verification

Step 3: Submit three alternative company names

Step 4: Pay NPR 100 name reservation fee

Step 5: Wait 1-3 working days for approval

The reserved name remains valid for 35 days from approval date.

Phase 2: Document Preparation

Required Documents for Company Registration Nepal:

- Application Form (Schedule 1 format)

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Citizenship certificates of shareholders

- Passport copies (for foreign investors)

- FDI approval letter (if applicable)

- Local authority recommendation letter

- Office location map

For Foreign Investors:

- Department of Industry approval

- Foreign Investment and Technology Transfer Act compliance

Phase 3: Capital Structure Declaration

|

Company Type |

Minimum Authorized Capital |

Minimum Paid-up Capital |

|

Private Limited |

NPR 100,000 |

NPR 100,000 |

|

Public Limited |

NPR 10,000,000 |

NPR 10,000,000 |

|

Single-Person Company |

NPR 100,000 |

NPR 100,000 |

|

Non-Profit Company |

NPR 100,000 |

NPR 100,000 |

Phase 4: Fee Payment

Company Registration Fees Nepal 2026:

|

Authorized Capital (NPR) |

Private Company Fee |

Public Company Fee |

|

Up to 100,000 |

NPR 1,000 |

NPR 15,000 |

|

100,001 - 5,00,000 |

NPR 4,500 |

NPR 40,000 |

|

5,00,001 - 25,00,000 |

NPR 9,500 |

NPR 70,000 |

|

25,00,001 - 1,00,00,000 |

NPR 16,000 |

NPR 1,00,000 |

|

Above 10,00,00,000 |

NPR 30 per lakh |

NPR 3,000 per crore |

Payment is accepted through online banking, mobile banking, or e-wallet services.

Phase 5: Verification & Approval

The Office of Company Registrar reviews applications within 3-7 working days. Upon approval, the Certificate of Incorporation is issued electronically.

Phase 6: Post-Registration Formalities

Within 30 days, the following must be completed:

- PAN registration at Inland Revenue Department

- Ward office registration at local municipality

- Share registry filing with OCR

- Corporate bank account opening

- VAT registration (if applicable)

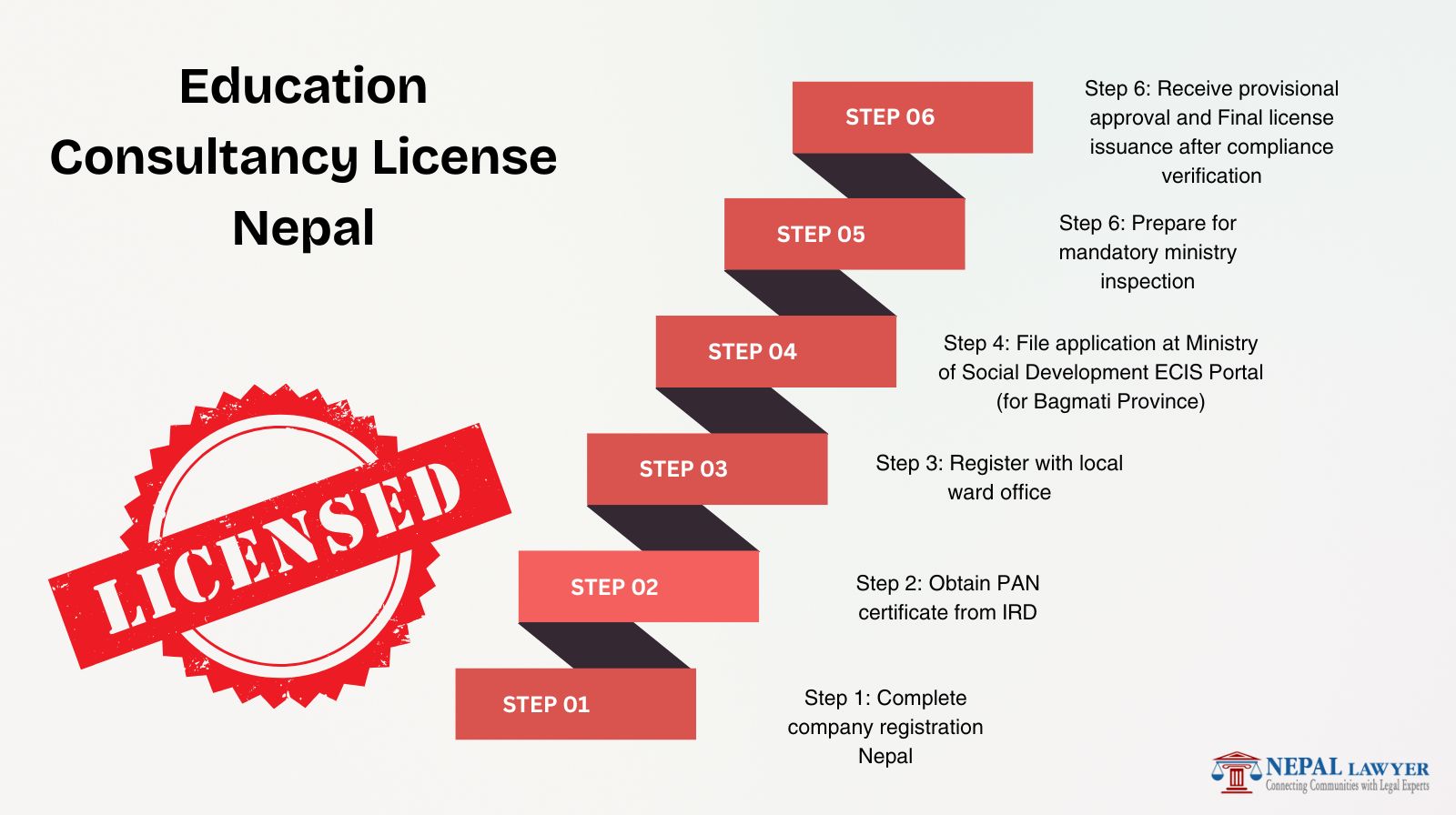

Education Consultancy License Nepal

The education consultancy license Nepal requires dual approval from MOSD Nepal and provincial ministries.

Why Education Consultancy License is Required

Without MOSD approval, education consultancies face closure and penalties. The Ministry of social development mandates strict compliance standards.

Step-by-Step Process

Step 1: Complete company registration Nepal (as described above)

Step 2: Obtain PAN certificate from IRD

Step 3: Register with local ward office

Step 4: Open corporate bank account with minimum NPR 500,000 capital

Step 5: File application at Ministry of Social Development ECIS Portal (for Bagmati Province)

Step 6: Prepare for mandatory ministry inspection

Step 7: Receive provisional approval

Step 8: Final license issuance after compliance verification

Mandatory Requirements

- Minimum two trained counselors employed

- Office space minimum 500 sq ft with designated counseling rooms

- Transparent fee structure documentation

- Language instructor certificates (if offering test prep)

- Clean police clearance for all directors

- Educational qualifications proof (minimum Bachelor's degree)

Provincial Variations

|

Province |

Governing Body |

Processing Time |

|

Bagmati |

Ministry of Social Development, Hetauda |

2-3 weeks |

|

Gandaki |

Ministry of Social Development, Pokhara |

3-4 weeks |

|

Lumbini |

Ministry of Social Development, Butwal |

2-3 weeks |

|

Sudurpashchim |

Ministry of Social Development, Dhangadhi |

3-4 weeks |

Education consultancy license Hetauda applications are processed faster due to digital infrastructure.

Inspection Criteria

The ministry inspection verifies:

- Physical infrastructure adequacy

- Counselor training documentation

- Student record-keeping systems

- Fee transparency compliance

- Fire safety measures

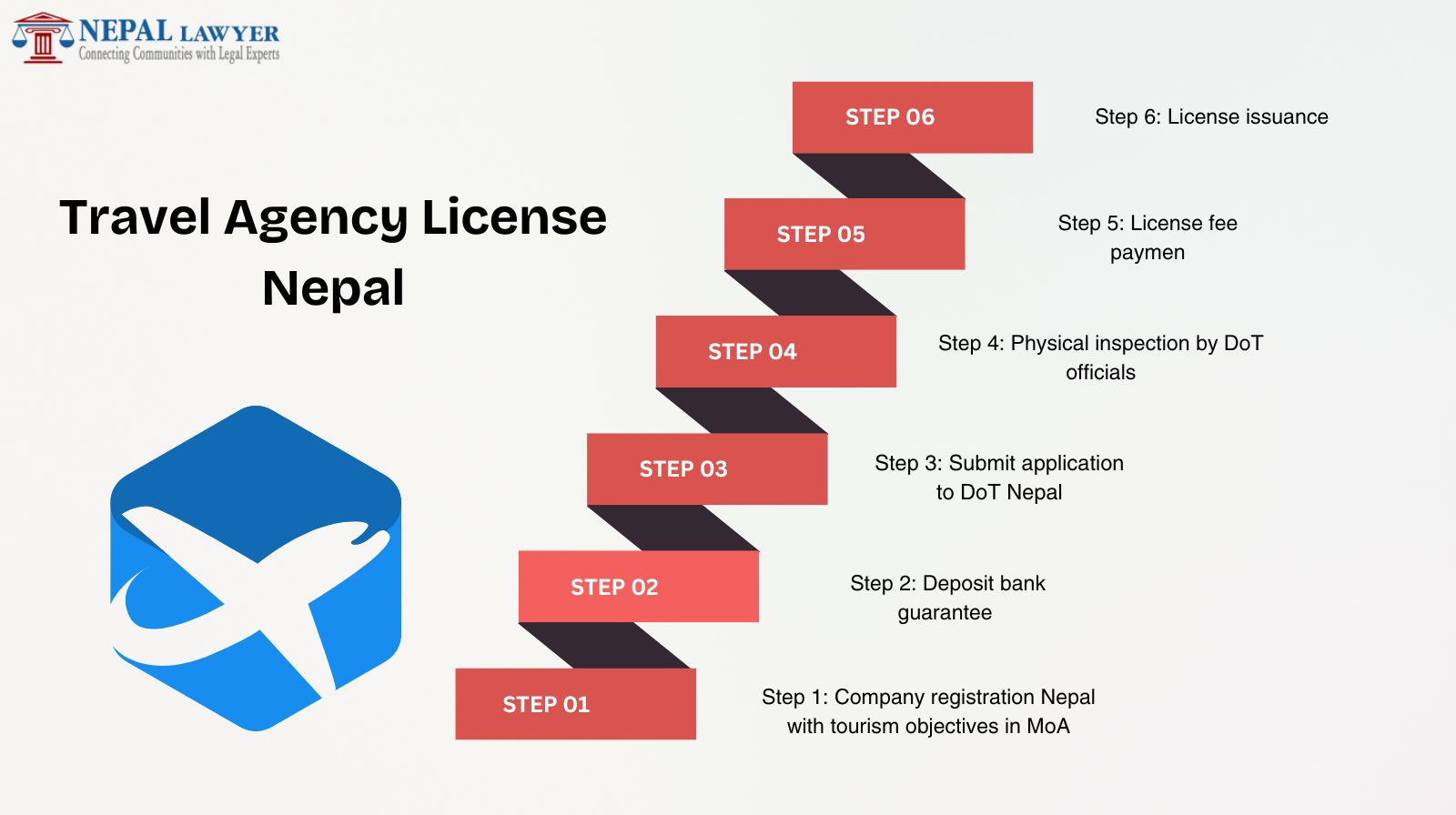

Travel Agency License Nepal | How to open Travel Agency in Nepal?

A travel agency license Nepal is essential for tour operators, trekking agencies, and travel consultants.

Governing Authority

The Department of Tourism (DoT Nepal) under Ministry of Culture Tourism and Civil Aviation issues all tourism permits.

License Categories

- Travel Agency License: For ticket booking and tour packages

- Trekking Agency License: For mountain expeditions

- Adventure Sports License: For rafting, paragliding, etc.

- Hotel/Lodge License: For accommodation services

Application Process

Step 1: Company registration Nepal with tourism objectives in MoA

Step 2: Deposit bank guarantee (NPR 50,000 - NPR 500,000 depending on category)

Step 3: Submit application to DoT Nepal with:

- Company registration certificate

- Tax clearance certificate

- Office lease agreement (minimum 3 years)

- Staff credentials (first aid certified for trekking)

- Insurance policies

Step 4: Physical inspection by DoT officials

Step 5: License fee payment (NPR 25,000 for standard travel agency)

Step 6: License issuance (valid for 5 years)

Special Requirements for Trekking Agencies

- Guide certification from Nepal Academy of Tourism and Hotel Management

- First aid training for at least 2 staff members

- Emergency evacuation plan documentation

- Equipment safety certificates

Renewal Process

Tourism licenses must be renewed every 5 years with:

- Updated tax clearance

- Renewal fee NPR 15,000

- Compliance audit report

- Staff training certificates

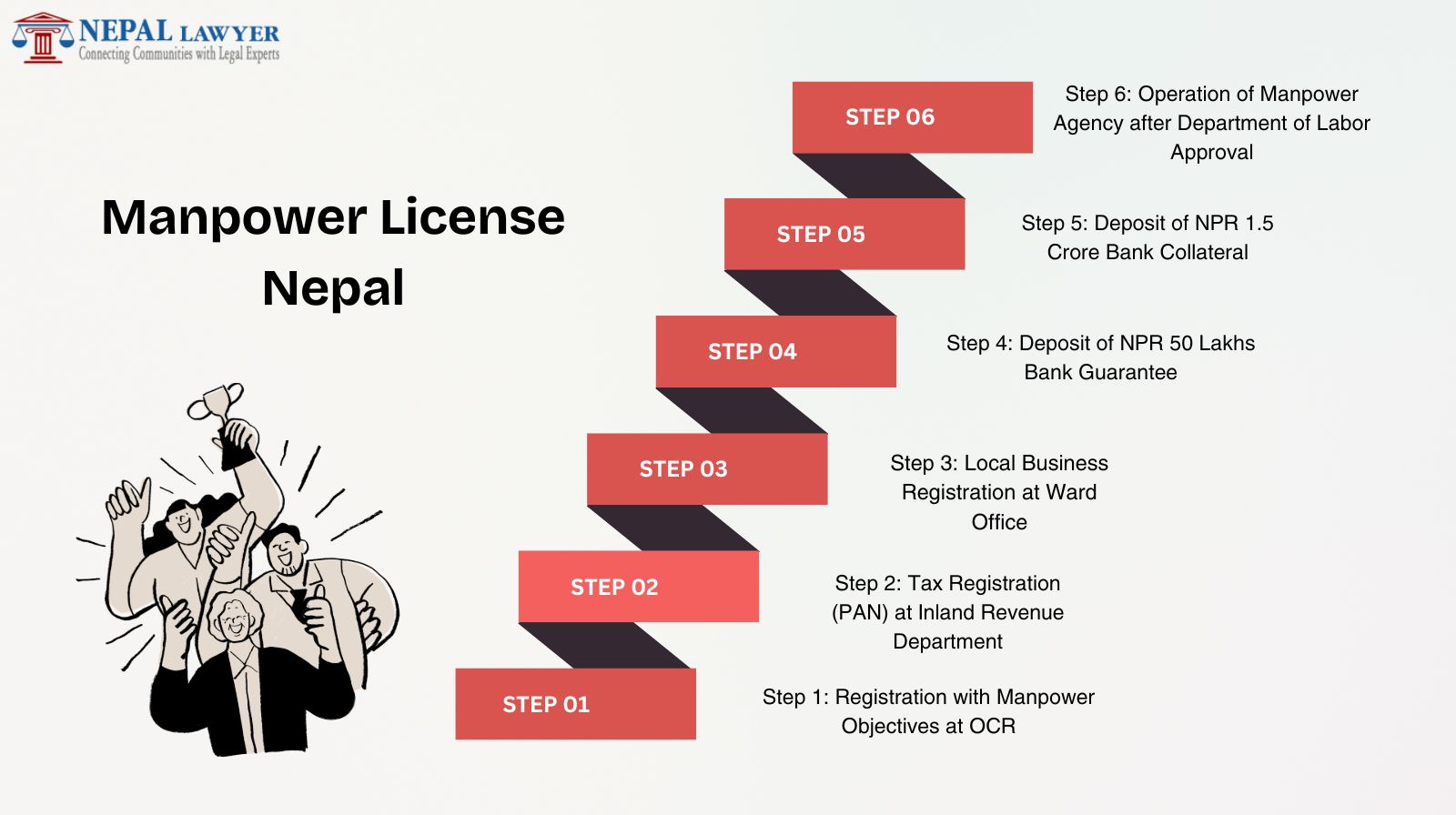

Manpower License Nepal

The manpower license Nepal is the most regulated business permit due to worker protection concerns.

Why Strict Regulation Exists

The Department of Foreign Employment (DoFE Nepal) enforces rigorous standards to prevent exploitation of Nepali workers abroad.

Financial Requirements

|

Requirement |

Amount (NPR) |

Refund Status |

|

Bank Guarantee |

5,00,000 |

Refundable |

|

Cash Deposit |

1,50,00,000 |

Refundable |

|

Minimum Capital |

50,00,000 |

Non-refundable |

|

License Fee |

25,000 |

Non-refundable |

|

Annual Renewal |

15,000 |

Non-refundable |

Total initial capital required: NPR 1,55,25,000

Eligibility Criteria

- Private limited company registration

- Clean criminal record of all promoters

- Minimum 5 years experience in HR or related field

- Office infrastructure meeting DoFE standards

- Dedicated grievance handling system

Documentation Checklist

- Company registration certificate

- MoA/AoA with foreign employment objectives

- PAN certificate

- Municipal business registration

- Audited financial statements

- Citizenship certificates (promoters)

- Police clearance certificates

- Bank deposit confirmations

- Qualification certificates

- Office ownership/lease documents

Processing Timeline

|

Phase |

Activity |

Duration |

|

Phase I |

Company incorporation |

5-10 days |

|

Phase II |

Financial compliance |

7 days |

|

Phase III |

Application submission |

10 days |

|

Phase IV |

Verification & inspection |

20-25 days |

|

Phase V |

License issuance |

7 days |

Total time: 49-59 days

Post-License Obligations

- Monthly recruitment reports submission

- Worker pre-departure orientation compliance

- Transparent fee structure maintenance

- Annual renewal within 3 months of fiscal year end

- Random DoFE inspections

Non-compliance penalties: Fines up to NPR 500,000, license suspension, or criminal charges.

PAN & VAT Registration Process

After company registration Nepal, tax registrations are mandatory.

PAN Registration Nepal

The Permanent Account Number (PAN) is issued by IRD Nepal for all taxpayers.

Required Documents

- Company registration certificate

- MoA/AoA copies

- Citizenship of directors

- Office address proof

- Application Form 2

Fees

- Individuals: NPR 200

- Entities: NPR 1,000

Processing Time

Online applications are processed in 1-3 days.

VAT Registration Nepal

Value Added Tax registration is compulsory when:

- Annual turnover exceeds NPR 5 million (goods) or NPR 2 million (services)

- Engaged in import/export

- Operating liquor/cigarette business

Application Process

- Access taxpayerportal.ird.gov.np

- Complete Form VAT 01

- Upload PAN certificate and financial projections

- Submit physical documents to local IRD office

- Biometric verification of owner

- Receive VAT certificate (7-10 days)

VAT Rate Structure

- Standard rate: 13%

- Zero-rated: Exports

- Exempt: Basic food items, education, health

Post-License Compliance Requirements

Maintaining business license Nepal validity requires ongoing compliance.

Annual Compliance Calendar

|

Month |

Requirement |

Authority |

|

Shrawan |

Annual return filing |

OCR |

|

Ashoj |

License renewal (education) |

MoEST and MOSD |

|

Poush |

Tax audit submission |

IRD |

|

Chaitra |

Industry report filing |

DOI |

|

Ashadh |

Tourism license renewal |

DoT |

Mandatory Filings

- Annual returns with audited financials to OCR

- Tax returns monthly/quarterly to IRD

- Industry operation reports to Department of Industry

- Worker recruitment records to DoFE (for manpower)

- Tourism activity reports to DoT

Record Maintenance

Businesses must preserve:

- Shareholder registers (permanent)

- Financial records (7 years)

- Tax documents (7 years)

- Employment records (3 years)

- License copies (current + expired)

Fees and Timelines Summary

One-Time Costs

|

License Type |

Government Fees |

Professional Fees |

Total Estimate |

|

Company Registration |

NPR 1,000-43,000 |

NPR 15,000-25,000 |

NPR 16,000-68,000 |

|

PAN Registration |

NPR 1,000 |

NPR 2,000 |

NPR 3,000 |

|

Education Consultancy |

NPR 5,000 |

NPR 20,000 |

NPR 25,000 |

|

Travel Agency |

NPR 25,000 |

NPR 15,000 |

NPR 40,000 |

|

Manpower License |

NPR 25,000 |

NPR 50,000 |

NPR 75,000 |

Recurring Annual Costs

|

Compliance Item |

Frequency |

Cost (NPR) |

|

License renewal |

Annual |

3,000-15,000 |

|

Tax filing |

Monthly/Annual |

5,000-20,000 |

|

Audit fees |

Annual |

15,000-50,000 |

|

Ward renewal |

Annual |

1,000-5,000 |

FAQs

What is the fastest way to complete business registration in Nepal?

The company registration Nepal process can be completed in 1-5 working days if all documents are prepared correctly and submitted through the OCR online portal. However, sector-specific licenses may take additional time.

Can foreigners own 100% of a business in Nepal?

Foreign ownership is permitted in most sectors under the Foreign Investment and Technology Transfer Act, 2075. However, approval from the Department of Industry Nepal is required, and certain sectors have equity caps.

Is PAN registration mandatory before applying for other licenses?

Yes, PAN registration in Nepal must be completed immediately after company registration. Most licensing authorities require PAN as a prerequisite document.

How often must business licenses be renewed?

|

License Type |

Validity Period |

Renewal Deadline |

|

Company Registration |

Permanent |

Annual returns only |

|

Tourism License |

5 years |

Before expiry |

|

Manpower License |

1 year |

Within 3 months of fiscal year end |

|

Education Consultancy |

1 year |

Before Ashoj end |

|

PAN |

Permanent |

Update changes only |

|

VAT |

Permanent |

File returns regularly |

What happens if a business operates without proper licensing?

Operating without a business license in Nepal can result in:

- Fines up to NPR 500,000

- Business closure orders

- Criminal prosecution

- Blacklisting from future registrations

Are online applications accepted for all license types?

Most licenses accept online applications through respective portals:

- OCR portal (ocr.gov.np)

- IRD portal (ird.gov.np)

- DoFE portal (dofe.gov.np)

- MoEST ECIS portal

What is the minimum capital requirement for a private limited company?

The minimum authorized capital for private limited companies is NPR 100,000 under the Company Act 2063. However, sector-specific minimums may apply.

How can license verification be done?

Official verification is available through:

- OCR verification portal (for company registration)

- IRD PAN verification system

- DoT licensee directory

- DoFE registered agency list

Which license is most difficult to obtain?

The manpower license Nepal is the most challenging due to stringent financial requirements (NPR 15.5 million deposit) and complex compliance obligations.

Is VAT registration required for service-based consultancies?

If annual turnover exceeds NPR 2 million, VAT registration Nepal becomes mandatory for education consultancies and other service providers.

Legal Sources

For verification and detailed study, consult these official sources:

- Office of Company Registrar Nepal: ocr.gov.np - Primary authority for company registration Nepal

- Inland Revenue Department: ird.gov.np - Tax registration and PAN/VAT registration Nepal

- Department of Tourism Nepal: tourismdepartment.gov.np - Travel agency license Nepal and trekking permits

- Department of Foreign Employment: dofe.gov.np - Manpower license Nepal applications

- Ministry of Education, Science and Technology: moe.gov.np - Education consultancy license Nepal approvals

- Company Registration Portal: camis.ocr.gov.np - Online business registration process Nepal

- Taxpayer Portal: taxpayerportal.ird.gov.np - Online tax registrations

- Ministry of Industry, Commerce and Supplies: moics.gov.np - Industrial policy framework

- Nepal Rastra Bank: nrb.org.np - Banking regulations for deposits

- Investment Board Nepal: investmentboard.gov.np - Foreign investment approvals

Legal Framework Documents

- Companies Act, 2063 (2006)

- Industrial Enterprises Act, 2076 (2020)

- Foreign Employment Act, 2064 (2007)

- Tourism Act, 1978

Final Professional Guidance

Navigating the business license process in Nepal demands meticulous attention to legal details. While this guide provides comprehensive information, individual circumstances vary. Professional legal consultation is recommended for complex cases, foreign investment structures, and sector-specific compliance.

Call to Action: Ready to start your business? Begin with OCR portal registration today. For specialized assistance, consult licensed legal practitioners registered with the Nepal Bar Association.

Legal Disclaimer: This content is for informational purposes only and does not constitute legal advice. Regulations change frequently; always verify current requirements with official authorities before proceeding.