Why Software Company Registration in Nepal Must Be Your First Priorit

Software company registration in Nepal has become essential for tech entrepreneurs seeking legal recognition. The digital economy is being transformed rapidly, and proper IT company registration Nepal processes must be followed to operate legitimately. Before any coding begins, your business structure must be established through official channels.

The legal framework governing software development company Nepal operations was established by the Company Act 2063 (2006). Additionally, the Electronic Transactions Act 2063 (2006) must be complied with for digital businesses. Without proper registration, contracts cannot be enforced, bank accounts cannot be opened, and international clients cannot be served reliably.

Legal Framework for Software Company Registration Nepal

The Company Act 2063 (2006) must be understood before registration is attempted. This legislation provides the foundation under which all companies are registered. For technology businesses, the Electronic Transactions Act 2063 (2006) must also be considered.

The Office of Company Registrar (OCR) must be approached for primary registration. The OCR is located in Kathmandu and operates through the official portal ocr.gov.np. All documents must be submitted through this platform. The Inland Revenue Department (IRD) must be contacted subsequently for PAN registration.

Foreign investors must note that the Foreign Investment and Technology Transfer Act (FITTA) must be complied with. Minimum investment thresholds must be met, and approval from the Department of Industry must be obtained.

Key Legal Requirements That Must Be Met

- Company name must be unique and approved by OCR

- Memorandum of Association must be drafted correctly

- Articles of Association must be prepared per legal standards

- Minimum capital must be deposited (NPR 100,000 minimum recommended)

- Shareholders must be at least one for private companies

- Directors must be appointed (minimum one for private limited)

- Registered office must be established within Nepal

Requirements for Software Company Registration in Nepal

Before registration is initiated, several prerequisites must be fulfilled. These requirements must be collected to avoid delays in the IT company registration Nepal process.

Essential Prerequisites

|

Requirement |

Details |

Why It’s Needed |

|

Unique Company Name |

Not used by existing entities |

Legal identification |

|

Citizenship/Passport |

Copies of all founders |

Identity verification |

|

Registered Address |

Physical office in Nepal |

Official correspondence |

|

Minimum Capital |

NPR 100,000+ deposited |

Financial viability |

|

Director Details |

Minimum 1 director |

Governance structure |

|

Shareholder Information |

Minimum 1 shareholder |

Ownership proof |

|

Digital Signature |

For online submissions |

Authentication |

All documents must be notarized before submission is made. The registration process cannot proceed without these requirements being met.

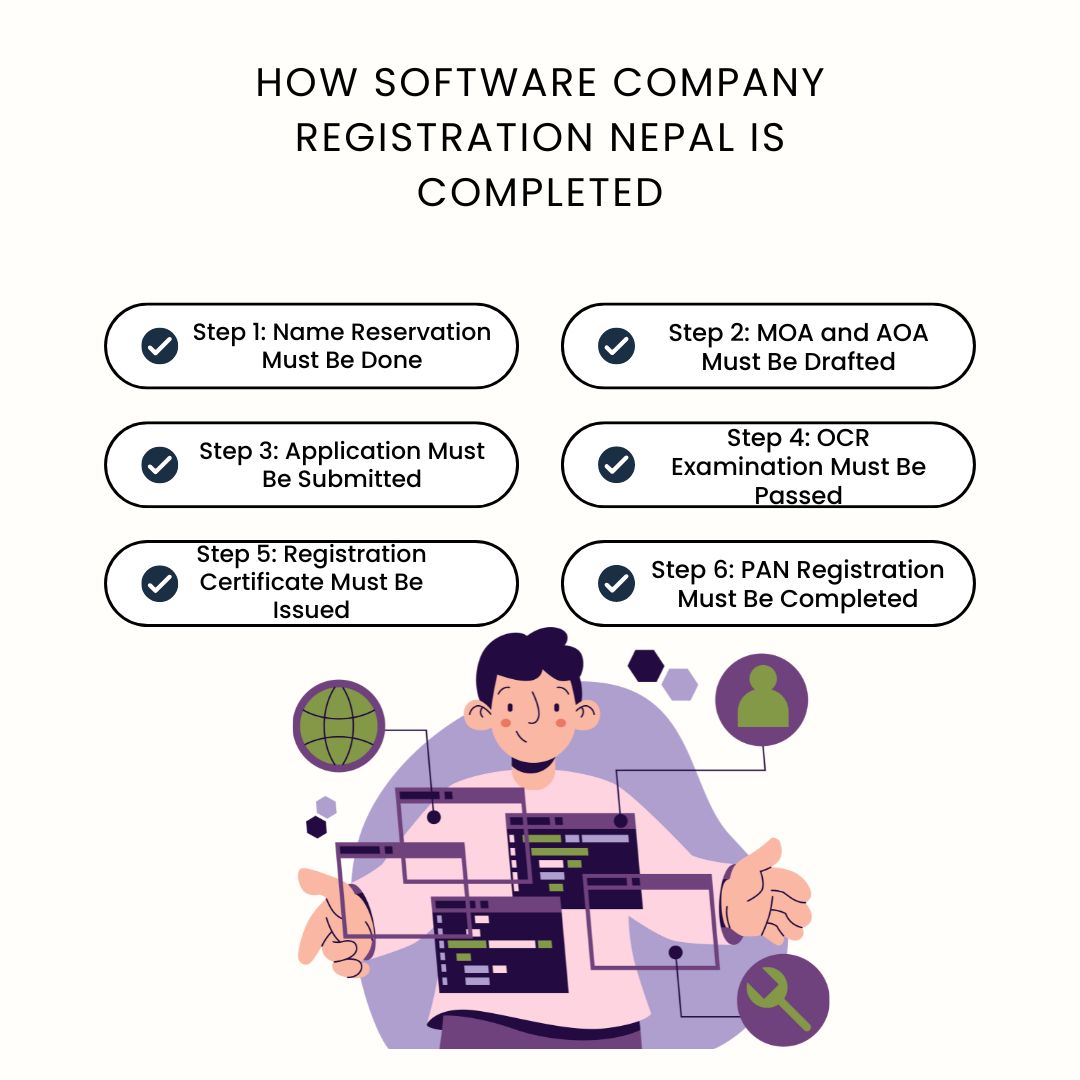

Step-by-Step Process: How Software Company Registration Nepal Is Completed

The software company registration in Nepal process must be followed sequentially. Each step must be completed before the next is attempted.

Step 1: Name Reservation Must Be Done

The OCR portal must be accessed at ocr.gov.np. An account must be created, and a username/password must be obtained. The proposed company name must be entered and checked for availability. Approval for name reservation is typically granted within 1-2 working days. A fee of NPR 100 must be paid.

Step 2: MOA and AOA Must Be Drafted

The Memorandum of Association must be prepared carefully. This document must outline the company’s objectives, capital structure, and shareholder details. The Articles of Association must be drafted to define internal management rules. Both documents must be signed by all shareholders and notarized.

Step 3: Application Must Be Submitted

All documents must be uploaded to the OCR portal. The application form must be filled accurately. Registration fees must be paid based on authorized capital. Companies with NPR 100,000 capital must pay approximately NPR 1,000. Higher capital requires higher fees, up to NPR 9,500.

Step 4: OCR Examination Must Be Passed

Submitted documents must be reviewed by OCR officials. Verification of signatures, objectives, and compliance with Company Act 2063 must be completed. If discrepancies are found, corrections must be made and resubmission must be done. This step typically takes 5-7 working days.

Step 5: Registration Certificate Must Be Issued

Upon successful examination, the Company Registration Certificate must be issued by OCR. This certificate serves as proof of legal existence. The process up to this point typically takes 7-10 working days total.

Step 6: PAN Registration Must Be Completed

The Inland Revenue Department must be visited for PAN registration. The company registration certificate must be presented. PAN is typically issued within 2-3 working days at no cost.

Step 7: VAT Registration Must Be Obtained (If Applicable)

If annual turnover is expected to exceed NPR 5 million, VAT registration must be obtained. The same IRD office must be approached. VAT certificate must be obtained before taxable supplies begin.

Documents Required for Software Company Registration Nepal

All required documents must be collected before submission is attempted. Missing documents cause rejection.

Primary Documentation Checklist

|

Document |

Purpose |

Where to Obtain |

|

Application Form |

Official request |

OCR portal |

|

Name Approval Letter |

Proof of reserved name |

OCR system |

|

MOA & AOA |

Legal structure |

Legal professional |

|

Citizenship Copies |

Identity proof |

Local ward office |

|

Passport (Foreigners) |

Foreign investor ID |

Home country |

|

Photos |

Director identification |

Photo studio |

|

Address Proof |

Office verification |

Landlord/Lalpurja |

|

Shareholder Agreement |

Ownership terms |

Legal draft |

|

Bank Deposit Slip |

Capital proof |

Commercial bank |

All documents must be scanned clearly for online submission. Originals must be kept for physical verification if requested.

Cost Breakdown: What Must Be Paid for IT Company Registration Nepal

The total cost must be budgeted accurately. Registration fees must be paid to government authorities. Professional fees must be paid to legal consultants.

Government Fees That Must Be Paid

|

Service |

Fee (NPR) |

Authority |

|

Name Reservation |

100 |

OCR |

|

Company Registration |

1,000 - 9,500 |

OCR |

|

PAN Registration |

0 |

IRD |

|

VAT Registration |

0 |

IRD |

|

Industry Registration |

500 - 1,000 |

DOI |

Professional Fees That Must Be Paid

|

Service |

Fee (NPR) |

Provider |

|

MOA/AOA Drafting |

2,000 - 5,000 |

Lawyer |

|

Notarization |

500 - 1,000 |

Notary public |

|

Consultation |

3,000 - 10,000 |

Business consultant |

|

Total Estimated Cost |

6,100 - 26,600 |

All inclusive |

The entire process must be completed within 7-10 working days if all documents are prepared correctly.

Tax Obligations After Software Company Registration Nepal

After registration is completed, tax compliance must be maintained. Several tax registrations must be obtained, and ongoing filings must be submitted.

Mandatory Tax Registrations That Must Be Obtained

Permanent Account Number (PAN) must be obtained from IRD immediately after registration. This must be done within 30 days of incorporation.

Value Added Tax (VAT) must be registered if annual turnover exceeds NPR 5 million. The VAT rate of 13% must be charged on taxable supplies.

Tax Rates That Must Be Paid

|

Tax Type |

Rate |

Applicability |

|

Corporate Income Tax |

25% |

On net profit |

|

VAT |

13% |

On goods/services |

|

TDS |

1.5%-15% |

On payments |

|

Social Security |

31% |

On salaries |

|

Advance Tax |

Quarterly |

Estimated income |

Tax Incentives That May Be Availed

Software companies established in underdeveloped areas must be granted 100% tax exemption for first five years. Companies employing over 100 Nepali citizens must receive 50% exemption for next three years. These incentives must be applied for through IRD.

Benefits of Software Development Company Nepal Registration

Multiple advantages must be gained through proper registration. These benefits must be understood to appreciate the registration process.

Legal Protection Must Be Obtained

Limited liability protection must be secured. Personal assets must be separated from business liabilities. The company name must be legally protected from use by others.

Business Credibility Must Be Enhanced

Trust must be built with clients. International contracts must be signed confidently. Bank loans must be accessible. Investment opportunities must be attracted.

Government Incentives Must Be Accessed

IT sector incentives must be claimed. Subsidies must be applied for. Export promotion benefits must be utilized. Research and development grants must be sought.

Global Opportunities Must Be Explored

International payments must be received legally. Foreign partnerships must be established. Digital service exports must be facilitated. PayPal and other payment gateways must be accessible.

Foreign Investment in Software Company Registration Nepal

Foreign investors must follow additional procedures. FITTA regulations must be complied with strictly.

Requirements That Must Be Met by Foreign Investors

Minimum investment of NPR 50 million must be made. Approval from Department of Industry must be obtained. Investment Board Nepal must be approached for large investments. Technology transfer agreements must be signed if applicable.

Process That Must Be Followed

Investment proposal must be submitted to DOI. Documents must include company registration papers, financial statements, and passport copies. Approval typically takes 1-2 months. After approval, OCR registration must be completed.

Documents That Must Be Submitted

- Foreign investor's passport copy

- Bank reference letter

- Investment proposal

- Source of funds declaration

- Board resolution from parent company

- Joint venture agreement (if applicable)

Frequently Asked Questions About Software Company Registration Nepal

Q1: How long must the software company registration process take?

The process must be completed in 7-10 working days if all documents are prepared correctly. Name reservation takes 1-2 days, OCR examination takes 5-7 days, and PAN registration takes 2-3 days.

Q2: What minimum capital must be deposited?

NPR 100,000 must be deposited as minimum authorized capital for private limited companies. However, higher capital must be considered for credibility and larger projects.

Q3: Can registration be done without a physical office?

No, a registered office address in Nepal must be provided. Virtual offices are not accepted by OCR. A physical lease agreement or property ownership document must be submitted.

Q4: Must foreigners be present in Nepal for registration?

Physical presence is not mandatory. A power of attorney must be provided to a local representative. All documents must be notarized and apostilled from the investor's home country.

Q5: What taxes must be paid after registration?

Corporate income tax at 25% must be paid on profits. VAT at 13% must be charged if turnover exceeds NPR 5 million. TDS must be deducted on payments. Social security tax at 31% must be paid on salaries.

Q6: Can a single person register a software company?

Yes, one person must be both shareholder and director for private limited companies. However, at least one witness must sign the incorporation documents.

Q7: Must industry-specific licenses be obtained?

General software development does not require special licenses. However, if telecommunications services are provided, Nepal Telecommunications Authority license must be obtained. If data processing involves sensitive information, additional compliance must be maintained.

Q8: What post-registration compliances must be followed?

Annual returns must be filed with OCR within 6 months of fiscal year-end. Financial statements must be audited. Tax returns must be submitted monthly, quarterly, and annually. Board meetings must be held and minutes must be maintained.

Q9: Must software products be registered separately?

Software copyright must be registered with Nepal Copyright Registrar for intellectual property protection. This is separate from company registration and must be done for each product.

Q10: How must payment be received from international clients?

After registration, a foreign currency account must be opened with a commercial bank. Nepal Rastra Bank approval must be obtained for significant foreign transactions. Online payment gateways must be integrated through registered banks.

Common Mistakes That Must Be Avoided

Business objectives must be defined clearly in MOA. Generic descriptions must be avoided. Shareholder agreements must be drafted properly. Oral agreements must not replace written contracts.

Tax registration deadlines must be met. PAN application must not be delayed beyond 30 days. VAT registration must be obtained before reaching NPR 5 million threshold. Compliance calendars must be maintained.

Professional assistance must be sought. Legal formalities must not be handled independently if unfamiliar. Documentation errors must be prevented through expert review. Time and money must be saved by doing things correctly the first time.

Timeline Checklist: What Must Be Done When

Week 1:

- Name reservation must be completed

- MOA/AOA drafting must be finished

- Documents must be collected

- Application must be submitted

Week 2:

- OCR examination must be awaited

- Queries must be responded to promptly

- Registration certificate must be obtained

- PAN application must be submitted

Week 3:

- PAN must be received

- VAT registration must be applied for (if needed)

- Bank account must be opened

- Municipality registration must be completed

Ongoing:

- Monthly tax returns must be filed

- Quarterly advance tax must be paid

- Annual returns must be submitted

- Compliance must be maintained

Why Professional Assistance Must Be Engaged

Complexity must be recognized. Legal requirements must be interpreted correctly. Documentation must be prepared error-free. Time must be saved. Rejection risk must be minimized.

Compliance must be ensured beyond registration. Tax obligations must be understood. Labor laws must be followed. Data protection requirements must be met. International payment regulations must be navigated.

Growth must be planned. Capital increase procedures must be known. Share transfer formalities must be handled. Foreign investment rules must be understood. Exit strategies must be structured legally.

References

Official sources must be verified for accurate information. Government portals must be accessed directly. Forms must be downloaded from official websites. Updates must be checked regularly.

Office of Company Registrar (OCR) must be visited at application.ocr.gov.np for registration. Company Act 2063 must be reviewed for legal compliance. Inland Revenue Department must be accessed for tax registration.

Department of Industry must be consulted for foreign investment approval at doi.gov.np. Nepal Rastra Bank regulations must be checked at nrb.org.np for foreign currency transactions.

Investment Board Nepal must be approached for large investments through ibn.gov.np. Federation of Computer Association Nepal must be joined for industry representation at can.org.np.

For legal precedents, Supreme Court of Nepal decisions must be searched at supremecourt.gov.np. Law Commission of Nepal interpretations must be reviewed at lawcommission.gov.np.

Final Call to Action That Must Be Heeded

Software company registration in Nepal must be started today. Business potential must not be delayed by legal uncertainty. Professional consultation must be sought immediately. The registration process must be initiated by visiting ocr.gov.np now. Success in Nepal's growing IT sector must be secured through proper legal foundation.